(Reuters) – Futures linked to Canada's main stock index rose on Friday as crude and metal prices gained, while investors awaited U.S. Federal Reserve Chair Jerome Powell's address later in the day.

September futures on the S&P/TSX index were up 0.6% at 6:26 a.m. ET (10:26 GMT).

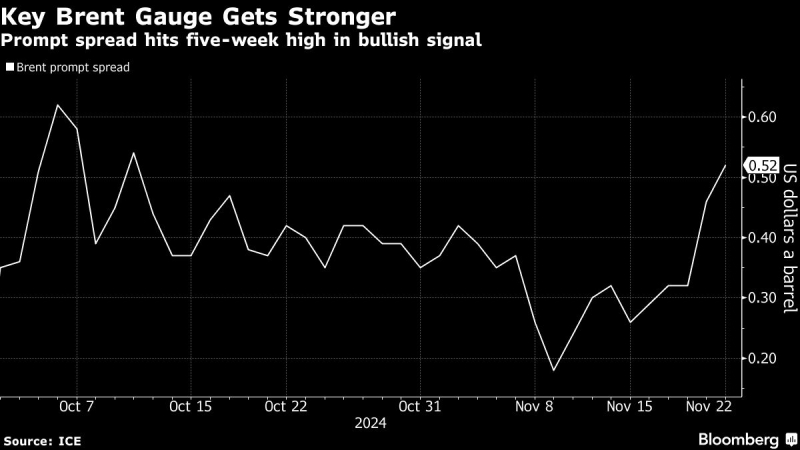

The energy sector is expected to be in focus as oil prices edged higher, though poised to register a weekly loss. [O/R]

The materials sector is likely to be impacted as gold prices inched up, while copper prices also gained. [GOL/] [MET/L]

Investors will follow Powell's commentary at the Jackson Hole Economic Symposium at 10:00 a.m. ET for clues on the U.S. interest-rate easing cycle, especially after recent dovish comments from policymakers backing reduction in borrowing costs.

After seeing the U.S. policy rates at 5.25% to 5.50% for over a year, market participants widely expect a 25-basis points reduction at the Fed's meeting next month.

In Canada, retail sales numbers expected at 8:30 a.m. ET could bolster the possibility of a third consecutive rate cut by the Bank of Canada, following this week's data that showed annual inflation at a 40-month low.

Meanwhile, major Canadian banks are set to report their quarterly numbers next week.

The S&P/TSX composite index ended lower on Thursday, after posting a record closing high in the previous session.

In corporate news, the Teamsters union said workers at Canadian National Railway will return to work after the government moved to end the lockout that threatened the economy.

However, work stoppage at Canadian Pacific Kansas City is expected to continue.

COMMODITIES

Gold: $2,497.42; +0.57% [GOL/]

US crude: $73.68; +0.92% [O/R]

Brent crude: $77.83; +0.79% [O/R]

FOR CANADIAN MARKETS NEWS, CLICK ON CODES:

TSX market report [.TO]

Canadian dollar and bonds report [CAD/] [CA/]

Reuters global stocks poll for Canada

Canadian markets directory

($1 = 1.3583 Canadian dollars)

(Reporting by Nikhil Sharma in Bengaluru; Editing by Shreya Biswas)