By Howard Schneider

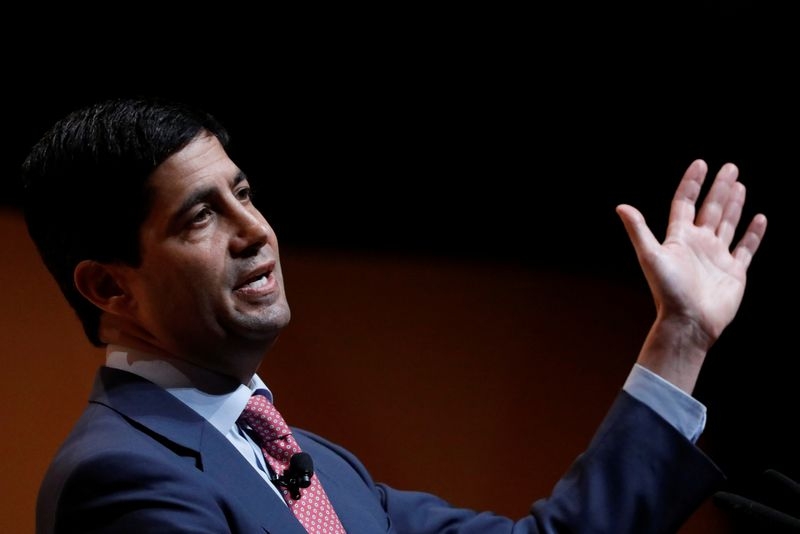

JACKSON HOLE, Wyoming (Reuters) – The imminent rate cuts planned by the U.S. Federal Reserve are "in line" with International Monetary Fund advice that has put a premium on ensuring inflation was controlled but now sees risks shifting toward the labor market, IMF economic counsellor Pierre-Olivier Gourinchas said on Friday.

"What was telegraphed by (Fed chair Jerome) Powell today is very much in line with what we've advocated," Gourinchas said on the sidelines of a Kansas City Fed economic conference. "Inflation has been improving and labor markets have shown signs of cooling … If labor markets are not contributing to inflation pressures anymore … then you might ease a little bit on cooling aggregate demand and bring (the policy rate of interest) back closer to neutral."

The Fed has maintained its benchmark interest rate in the 5.25% to 5.5% range for more than a year, a level policymakers feel is curbing economic activity.

In keynote remarks to the conference on Friday, Powell said bluntly that with inflation just a half-point above the Fed's 2% target and the unemployment rate rising, "the time has come for policy to adjust," remarks that cemented expectations for an initial rate cut at the Fed's Sept. 17-18 meeting. Depending on the outcome of an upcoming August jobs report, some economists anticipate the initial cut may even be a larger than usual half-point reduction.

The U.S. should not be "complacent" that inflation has disappeared, Gourinchas said, noting that service-sector prices are still rising and that the Fed will have to calibrate the pace and extent of rate cuts with incoming economic data.

"There is still some upside risk to inflation," he said.

Yet it was also clear the U.S. job market was cooling, Gourinchas said, though from a position of strength and ongoing economic growth.

"I don't think we are in a situation where recession is imminent" in the U.S., Gourinchas said, while the odds of a soft landing "have increased and that remains our baseline."

(Reporting by Howard Schneider; Editing by Rod Nickel)