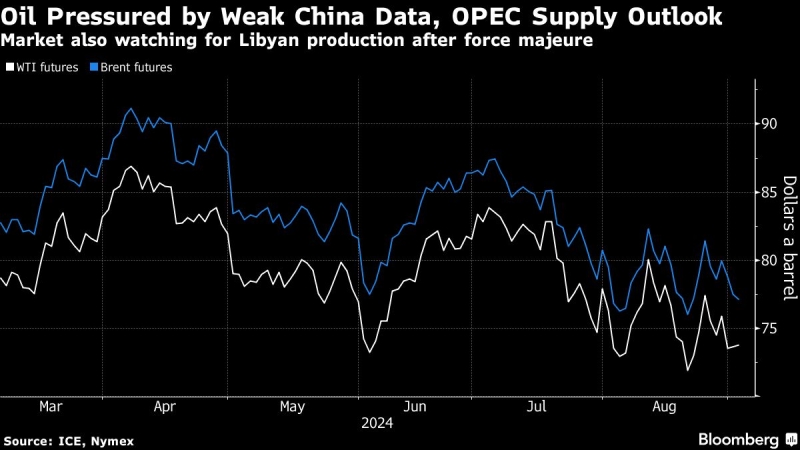

(Bloomberg) — Oil fell as Chinese demand concerns outweighed supply disruptions in Libya.

Most Read from Bloomberg

Global benchmark Brent dropped below $76 a barrel and West Texas Intermediate traded near $72. A further contraction in factory activity in China and a deepening property crisis are continuing to drag on the country’s economy, threatening growth targets.

Oil has wiped out almost all of this year’s gains during the past couple of months as economic concerns in key consumers — including China and the US — and ample supplies weigh on sentiment. The market is also bracing for the potential release of additional barrels from OPEC+.

A political crisis in OPEC member Libya, which has halved the country’s output, may give the alliance the space to move forward with a planned supply hike next quarter. The state oil firm this week declared force majeure at the key El-Feel field amid a widening shutdown of production.

“Oil-market concerns include the Chinese economy and oil demand, along with more oil from OPEC+ starting in October,” said Bjarne Schieldrop, chief commodities analyst at SEB AB.

The US, meanwhile, is laying the groundwork for new sanctions on Venezuelan government officials in response to Nicolás Maduro’s disputed reelection, according to documents seen by Bloomberg. The measures target key leaders that the US says collaborated with Maduro to undermine the July 28 vote.

To get Bloomberg’s Energy Daily newsletter in your inbox, click here.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.