(Bloomberg) — New legislation in Brazil is set to support farmers by pushing additional demand toward biofuels — and away from the fossil fuels produced by state-controlled oil giant Petroleo Brasileiro SA.

Most Read from Bloomberg

At its final stages in Congress, the “Fuel of The Future” bill from President Luiz Inacio Lula da Silva’s government creates broader mandates for biofuels, reinforcing Brazil’s strategy of relying on its bountiful crops to address the energy transition. It’s also a strong reminder for Petrobras of increasing pressure to invest in low-carbon alternatives.

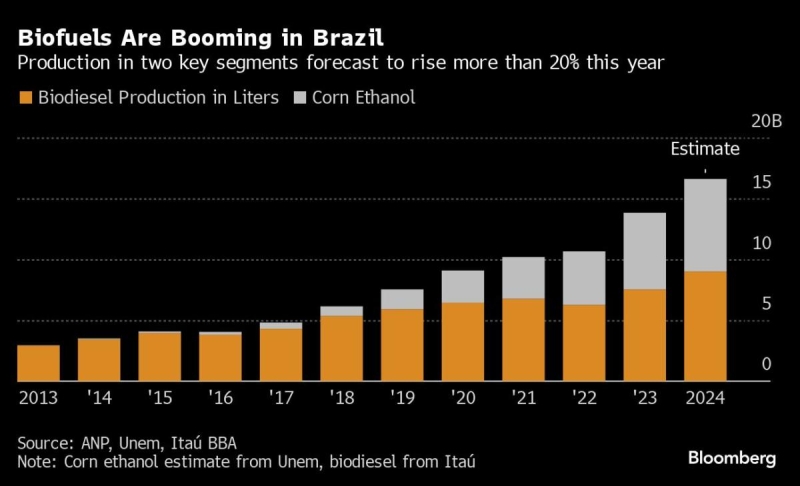

Brazil is already a huge biofuels’ consumer, producing flexible-fuel cars that can run on ethanol alone. The legislation, which passed Wednesday in the Senate and now returns to the lower house, would further boost demand for the crop-based fuel by increasing the allowable blend of ethanol in regular gasoline to as much 35% from 27.5% currently.

It would also increase the allowable blend of biodiesel in regular diesel to 20% from 14% over the next six years. And the government plans to oblige natural gas suppliers to gradually reduce emissions by purchasing biomethane.

“Petrobras is the biggest loser under the bill, and should see production drop in three of its main fuels: gasoline, diesel and natural gas,” Adriano Pires, a director at energy consultancy Brazilian Center for Infrastructure, said in an interview.

Gasoline consumption could drop as much as 11% with the increase of ethanol’s share in the blend, according to StoneX Group market analyst Isabela Garcia. While government technicians still need to validate the change, a 30% blend is already being tested — a move set to raise ethanol demand by 1.3 billion liters (343 million gallons) a year, according to agricultural consultancy Datagro. That’s equivalent to nearly 4% of Brazil’s total ethanol output for this season.

The boost is welcome news for sugar-cane millers including Raizen SA and Sao Martinho SA, which have seen recent weakness in ethanol demand hurt profits. “Mills will have more legal certainty to continue to invest in the expansion of ethanol production,” Datagro President Plinio Nastari said.

It will also benefit soy crushing companies such as Cargill Inc., which has the largest biodiesel producing capacity in Brazil. It acquired three soybean crushing and biodiesel production plants last year to bolster its facility in Três Lagoas, Mato Grosso do Sul state.

“We took an important step to grow in the sector,” said Rafael Luco, the company’s soy processing commercial lead. “This capacity is not being fully used. We continue to invest in the integration of operations and to leverage production in these locations.”

Farmers who grow Brazil’s top crops of soybeans and corn are looking to supply the expanding biofuels market. By 2035, new biodiesel and soybean crushing plants could see the amount of soy processed in the country nearly double, according to industry group Abiove, which represents Cargill and other trading companies including Bunge Global SA and Archer-Daniels Midland Co.

The government push on ethanol should also drive more investment in biofuel from corn, with industry group Unem seeing total production more than doubling through 2034.

That expansion also means Brazil’s biofuel boost will have a limited impact on sugar markets. While cane mills typically can shift production between ethanol and sweetener, current ethanol inventories are at “comfortable” levels, according to Ana Zancaner, an analyst at commodities trader Czarnikow Group. Any future shifts would depend on strong growth in overall fuel demand, she said.

Lula’s new fuel regulation also bolsters the case for Brazil’s state oil giant to pivot its investment plans. Petrobras is working on its next five-year spending plan, and investors currently see greener initiatives including hydrogen, carbon capture, wind and solar power as less profitable.

Latin America’s biggest oil producer is nonetheless preparing its refineries to meet increasing demand for low-carbon fuels. Petrobras has been developing sustainable products and studying partnerships, including a biorefinery with Mubadala Capital. It has also completed tests with petrochemicals supplier Braskem SA to produce a chemical product with using sugarcane ethanol.

But in another hurdle for Petrobras, its so-called diesel R isn’t a part of the mandatory green diesel blend defined in the new legal framework. Diesel R is made by co-processing fossil fuel with animal or vegetable oil, and an attempt to include it in the bill faced strong opposition from Brazil’s agribusiness caucus, which counts about 60% of lawmakers as members.

Petrobras Chief Executive Officer Magda Chambriard has vowed to replenish oil reserves she sees as key to funding energy transition initiatives. The company said in an e-mailed statement that it is following the bill’s progress in the Senate and waiting for that process to wrap up before concluding its assessment.

–With assistance from Daniel Carvalho.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.