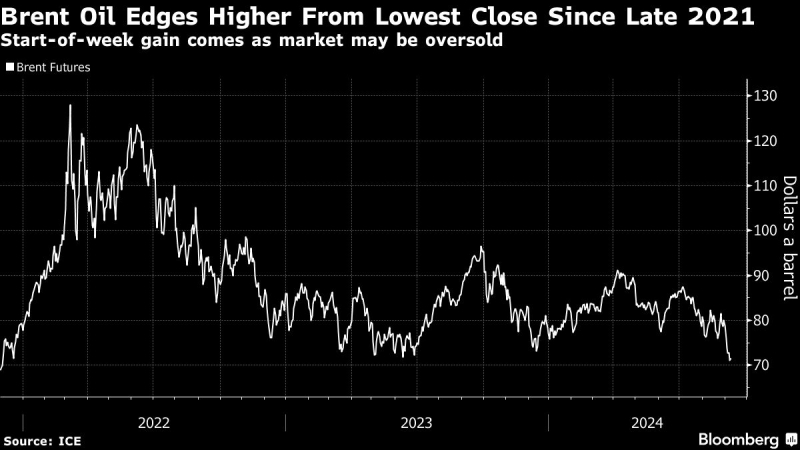

(Bloomberg) — Oil rose from its lowest close since 2021 after a deep weekly loss pushed futures close to levels regarded as oversold, with the focus this week on three reports that may clarify the demand outlook.

Most Read from Bloomberg

Global benchmark Brent advanced toward $72 a barrel after losing almost 10% last week, while West Texas Intermediate was above $68. Oil’s recent losses have been driven by signs of slowdowns in the US and China, endangering demand at a time of abundant supply. The slide left the 14-day relative strength index at 31, a signal losses may have been too rapid and too steep.

Traders will get plenty of market insights this week as three prominent forecasters — OPEC, the Energy Information Administration and the International Energy Agency — publish monthly outlooks. In addition, the Asia Pacific Petroleum Conference, a major industry gathering, takes place in Singapore.

Crude has tumbled for the past three weeks as the broader market mood becomes more bearish, joining other commodities and equities in a wide selloff that’s spooked investors. There has also been widespread softness in product markets, including US gasoline and European diesel. The weakness prompted OPEC+ to defer a plan to relax supply curbs by two months.

The start-of-week gain came despite a decision by Saudi Arabia to cut pricing of its flagship grade for its main market in Asia next month, reflecting the poor demand outlook. State-owned Saudi Aramco lowered the official selling price of Arab Light for buyers in Asia by 70 cents to $1.30 a barrel against the regional benchmark, according to a price list seen by Bloomberg.

The market’s ructions are reflected in widely watched timespreads, which point to physical conditions becoming less tight. Brent’s prompt spread — the gap between its two nearest contracts — was 38 cents a barrel in backwardation. While that remains a positive pattern, marked by a premium for the nearer contract, the gap was more than $1 two weeks ago

To get Bloomberg’s Energy Daily newsletter into your inbox, click here.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.