(Bloomberg) — All signs point to a tough few months ahead for investors charting the dollar’s path, after the US presidential debate and a key inflation reading left markets anticipating heightened volatility through year-end.

Most Read from Bloomberg

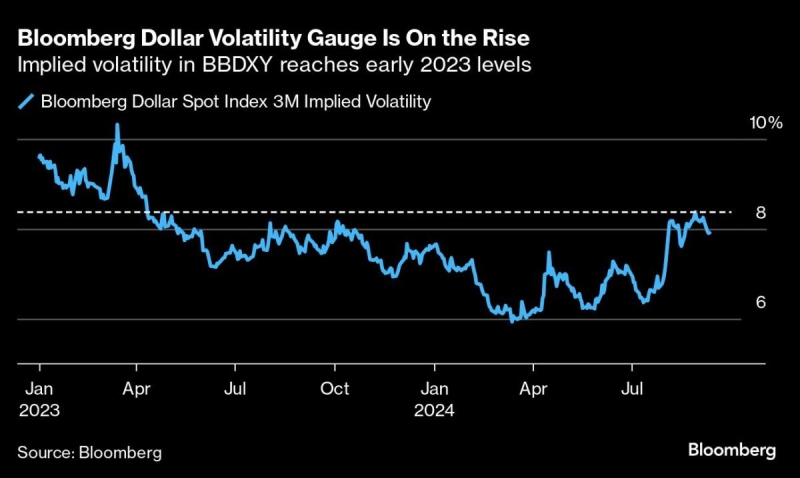

Currency managers are grappling with a dizzying array of cross-currents that stand to ramp up gyrations in exchange rates even further. With the Federal Reserve poised to cut interest rates next week and US elections looming, a measure of implied three-month volatility for the greenback is about as high as it’s been since the regional-banking crisis in early 2023.

The key, money managers say, is nailing the trajectory of the Fed, which they expect will be the primary driver of the dollar. But beyond that, they have to figure out if the market has factored in an appropriate amount of easing by the US central bank relative to its major peers and how to position around the November US vote. All the while, they must navigate a range of escalating geopolitical tensions that could ripple through markets in unpredictable ways.

“It’s so difficult to predict shorter-term currency movements,” said Derek Schug, head of portfolio management at Austin-based Kestra Investment Management. “We’re setting ourselves up for an extremely volatile path for the dollar for the rest of the year.”

The dollar was little changed on Thursday, though it weakened modestly Wednesday as traders further unwound bets linked to former President Donald Trump retaking the White House after Tuesday’s debate with Vice President Kamala Harris. The greenback hasn’t recouped much ground from an August slump that slashed its gain this year by more than half. With markets still anticipating about a percentage point of total Fed easing by year-end, even after underlying US inflation unexpectedly picked up in August, speculative investors are the most bearish on the dollar in more than a year.

Following are comments from market participants on their expectations for the dollar in the coming months:

Kathleen Brooks

Brooks is research director at XTB. The firm was the most-accurate forecaster of major currencies in the second quarter, data compiled by Bloomberg show.

What to watch: “Without a doubt, the No. 1 driver of the dollar is going to be relative interest-rate differentials. The outlook for the dollar for the rest of the year could really come down to the next few weeks.”

Any scaling back of bets on Fed rate cuts is likely to give the dollar breathing room, Brooks said. “I don’t think the election is a key factor in the FX market yet,” she added. “We’re at this precipice of monetary-policy change and that’s so much more important than politics for the market at the moment.”

The trade: “FX has been less volatile than any other asset this year, but you could see a gradual 2.5% recovery in the broad dollar,” she said. “Now, who does it recover against? The yen and euro.”

Still, she expects range-bound trading for the euro between $1.11 and $1.08 for the next three to six months, relative to about $1.10 now.

Kristina Campmany

Campmany is senior portfolio manager at Invesco on a global debt team managing $6 billion.

What to watch: “With the Fed about to embark on an easing cycle, albeit a midcycle adjustment or a more significant easing toward neutral, the US dollar can be in a more sustained downturn going forward.”

Such an adjustment could see the dollar weaken by up to 5% — or if Fed easing is sustained toward a neutral level, as much as 10%, Campmany said.

The trade: “It has been possible to extract currency carry,” in which investors borrow where rates are low and invest where they’re higher, “in a relatively efficient manner over the past year,” she said. “We believe this will continue as long as global economic activity remains robust.”

Invesco’s preference is for higher-yielding currencies like the Mexican peso and Brazilian real, while noting the idiosyncratic pressures on those currencies lately. They prefer to fund those positions through the dollar as a base currency but also the euro, yuan and Swiss franc.

Meera Chandan

Chandan is co-head of global currency strategy at JPMorgan Chase & Co. The bank was the No. 2 forecaster of major currencies in the second quarter, data compiled by Bloomberg show.

What to watch: “The dollar at its current juncture is splitting the currency universe into two parts, the low- and the high-yielders. The currencies that have been hit the hardest when US rates were going up, the low-yielders, are the currencies that are likely to be the most supported as rates come back down.”

The dollar’s performance will ultimately come down to the US growth outlook, Chandan said. “That’s even without the US elections thrown into the mix.”

The trade: “We’re defensively bullish on the dollar. We are still looking for dollar strength, but it’s a different kind of dollar strength from what we’ve seen in the last couple of years,” Chandan said. The support for the greenback could come from a risk-off haven trade, rather than US growth outperformance and high yields.

In a recession, the dollar-yen rate could drop below 135 yen or even below 130, she said, from about 142 yen per dollar now. However, “the dollar could still be stronger because all the cyclical currencies would be weaker.”

Jonathan Duensing

Duensing is head of US fixed income at Amundi US overseeing a team managing approximately $50 billion.

What to watch: “Given just how much is discounted in the front end of the US yield curve, it’s understandable that the dollar has weakened to the extent that it has. But to us it looks a little bit oversold here in the very near-term.”

Duensing said that if recession risk builds in the US, the dollar will likely rally amid a flight-to-quality. But the greenback may then weaken as the Fed eases policy beyond what’s currently priced into markets.

The trade: “If it’s a scenario where the Fed pulls off the soft landing on the inflation story and they’re able to keep the US economy in a position that that looks somewhere around potential growth, you probably see plus or minus 3% to 5% on the dollar over the course of the next year or so.”

Leah Traub

Traub is portfolio manager and head of the currency team at Lord Abbett, overseeing approximately $12.7 billion.

What to watch: “As I think about the order of priorities for the dollar into the end of the year, most important is the Fed beginning to cut rates. Then comes the global growth outlook, and last, the election.”

The US yield advantage is likely to narrow as the Fed lowers rates, said Traub. If the Fed cuts a quarter-point in September, it will likely ease the same amount in November, which could weigh on the dollar, she said. However, that scenario is also priced in.

“For a sustained dollar downturn, we need to see global growth pick up even as US growth weakens,” she said. “I look around the world and I’m not sure where I see that happening. Not in Germany, not in China.”

The trade: Rather than making large currency bets, the firm reflects US versus non-US views through its bond allocations.

“As the US economy has shown signs of slowing and the Fed has turned more dovish, we have shifted more duration exposure back to the US, while maintaining an overexposure to non-US credit,” she said.

Hedging costs for dollar-based investors remain favorable, she said. For example, buying a euro-denominated bond and hedging it back to the dollar via three-month forwards adds 1.6% in annualized carry, she said.

–With assistance from Stefani Reynolds.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.