(Bloomberg) — Mexico’s headline inflation slowed more than expected in early September, likely giving Banco de Mexico room to cut borrowing costs for a second straight month at Thursday’s interest rate meeting.

Most Read from Bloomberg

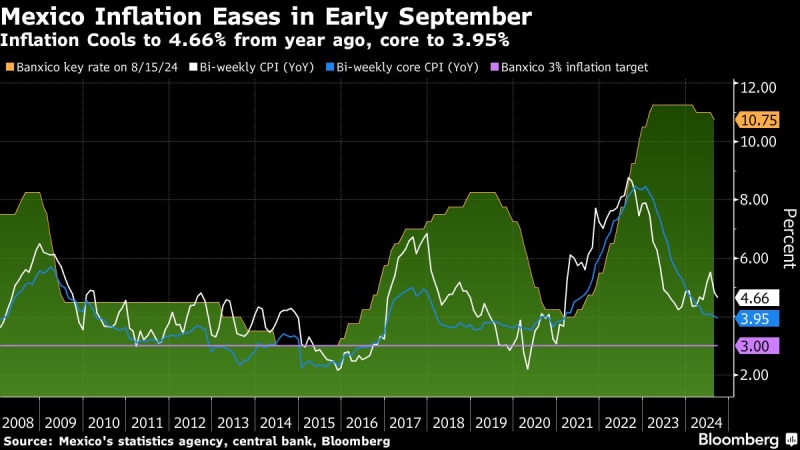

Official data published Tuesday showed consumer prices rose 4.66% in the first two weeks of the month from the same period a year earlier, just below the 4.71% median estimate of economists surveyed by Bloomberg. The print was below the 4.83% reading in the previous two-week period.

The closely-watched core inflation metric, which excludes volatile items such as food and fuel, slowed to 3.95% from 4.01% in the prior reading, roughly in line with the 3.96% median estimate. The central bank targets inflation at 3%, plus or minus one percentage point.

Last month, Banxico, as the central bank is known, cut its benchmark interest rate by 25 basis points, bringing borrowing costs down to 10.75% in a split decision. The majority of economists surveyed by Bloomberg expect policymakers to ease by another quarter-point to 10.5% on Thursday.

A few even see a cut to 10.25% that would mirror the US Federal Reserve’s decision last week to lower its benchmark rate by 50 basis points.

“Economic activity data has been confirming that the slowdown in Mexico has intensified,” Gabriel Casillas, chief Latin America economist at Barclays Plc. said before Tuesday’s inflation report. “The US Fed cut more compared to what Banxico had expected, opening up space for further easing.”

The Fed’s reduction was its first cut in four years and US policymakers have left the door open to further adjustments. Banxico lowered its 2024 growth forecast in August to 1.5% from 2.4%, in part as US manufacturing weakness has contributed to sluggishness in the Mexican economy.

President Andres Manuel Lopez Obrador’s proposal to have judges elected by popular vote was approved in both houses of Congress earlier this month, sparking a bout of peso volatility that could heighten caution among Banxico policymakers. The US electoral process has also contributed to swings in the currency’s value.

The peso has remained above 19 per dollar since late August.

–With assistance from Rafael Gayol.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.