Hard luck for the hard-landers yesterday. Yesterday's GDP report was full of upward revisions:

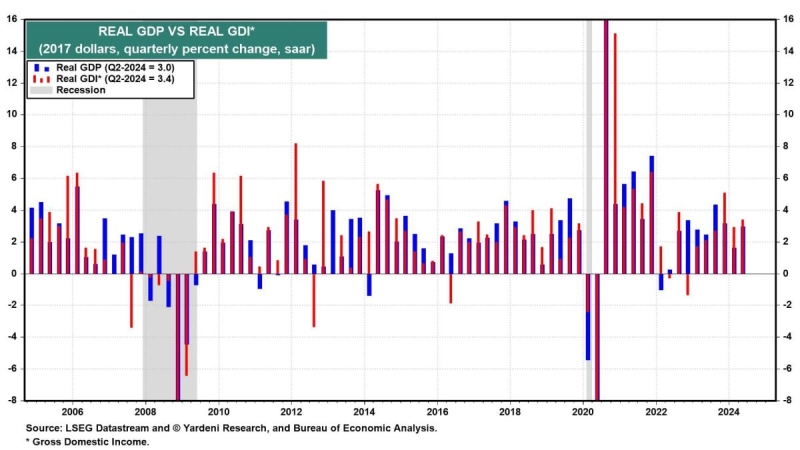

Some of the hard-landers expected GDP to be revised lower after a large gap between GDP (which measures output) and Gross Domestic Income (GDI) (which measures economic activity via wages and profits) emerged over the past few quarters.

Over time, GDI closely tracks GDP, but discrepancies tend to be revised in favor of the weaker indicator when the economy is slowing.

Yesterday, an update from the Bureau of Economic Analysis (BEA) showed that GDI has actually been understated. Higher incomes drove the upward revision.

The previous estimate of Q2 real GDP showed it rose 3.0% (saar), while real GDI increased by 1.3%. That created the largest gap between the two since 1993.

The BEA's final estimate of Q2 real GDI raised it to 3.4%. GDI was also revised higher in Q1, from 1.3% to 3.0% (chart). Real GDP growth remained at 3.0% during Q2 and was revised up slightly to 1.6% in Q1.

Furthermore, the technical recession from two straight quarters of negative real GDP growth in H1-2022 was revised away as well.

Real GDP vs Real GDI

Much of the increase in GDI was due to increased worker compensation. Real disposable personal income growth was raised from 1.0% to 2.4% (chart).

Disposable Personal Income

Original Post

Related Articles