(Bloomberg) — Oil opened the week lower as the market waited to see if Israel would retaliate against Tehran for a missile attack last week, with President Joe Biden discouraging a strike on Iran’s crude fields.

Most Read from Bloomberg

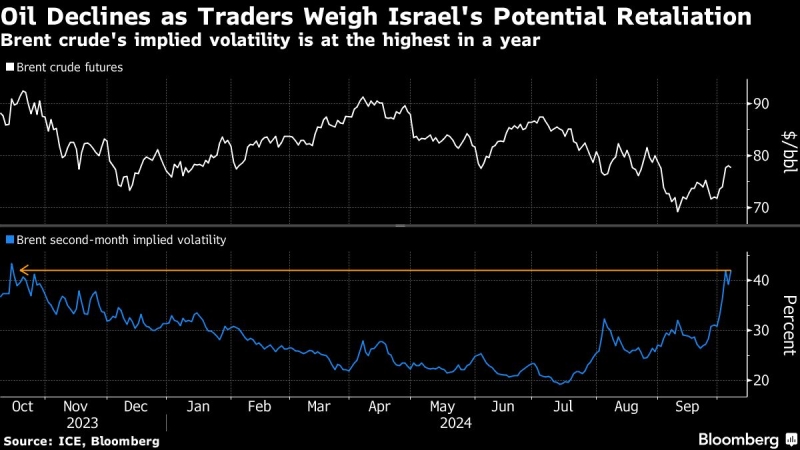

Brent slipped below $78 a barrel after jumping the most since January 2023 last week, while West Texas Intermediate was near $74. Biden said on Friday that he didn’t know when an Israeli response would come, but “I’d be thinking about other alternatives than striking oil fields.”

Iran’s attack on Israel has raised fears over an all-out war in the Middle East, and prompted a flurry of action in the options market. Still, questions about the demand outlook — especially from No. 1 importer China — and oversupply continue to hang over the market.

The Middle East remains on edge, with as Israel sending troops back into northern Gaza over the weekend and keeping up aerial attacks and limited ground maneuvers in Lebanon. Iran’s oil output has returned to almost full capacity and could be vulnerable as tensions escalate.

Options markets for oil continue to retain their bias toward bullish call options — which profit buyers when futures gain. A gauge of implied volatility for Brent rose to the highest in almost a year. Money managers have also added more net-long positions for Brent.

Oil is likely to price in a sustained geopolitical premium until the conflict between Israel and Iran is resolved, JPMorgan Chase & Co. analysts including Natasha Kaneva said in a note. Attacking Tehran’s energy facilities wouldn’t be the preferred course of action, they said.

Saudi Arabia, meanwhile, raised its main oil price for buyers in Asia by a greater-than-expected amount, while simultaneously cutting prices of all grades exported to the US and European markets.

To get Bloomberg’s Energy Daily newsletter into your inbox, click here.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.