(Bloomberg) — Brazil analysts raised their key rate forecasts for next year after inflation sped up and President Luiz Inacio Lula da Silva reignited fears of even looser fiscal policy ahead.

Most Read from Bloomberg

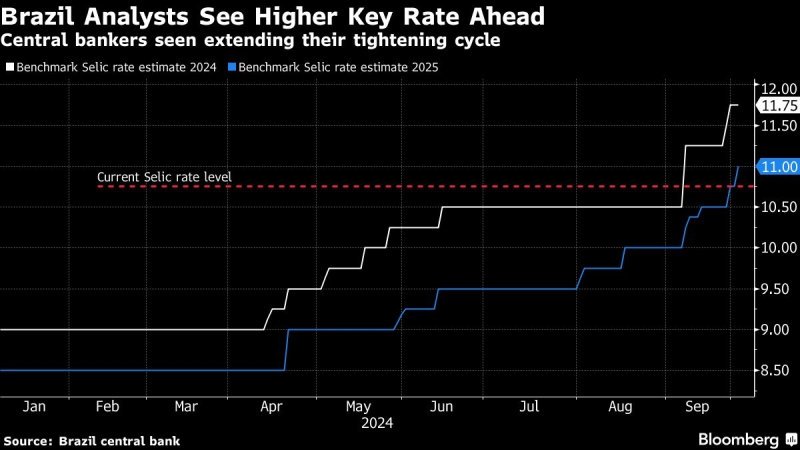

The benchmark Selic will hit 11% at year-end 2025, up from the prior estimate of 10.75%, according to a weekly central bank survey published Monday. Estimates for borrowing costs this December stayed unchanged at 11.75%.

Latin America’s largest economy has proved more resilient than expected most of this year, prompting policymakers to kick off a tightening cycle in September by lifting borrowing costs to 10.75%. Economic activity rose 0.2% on the month in August, above the 0.1% median estimate from analysts in a Bloomberg survey. From a year prior, the gauge gained 3.1%, according to a separate report published by the central bank on Monday morning.

Low unemployment, a weaker real and an increase in families’ disposable income due in part to higher government transfers are reigniting fears of inflation pressures. Consumer prices rose 4.42% in September from a year prior, nearing the top of the central bank’s tolerance range ceiling as food and energy costs jumped on the back of severe drought.

Analysts in the survey expect inflation at 4.39% this December and 3.96% at the end of next year, both figures above the bank’s 3% target. In a twelve-month horizon, cost-of-living rises are seen at 3.96%.

Policymakers have said they remain data-dependent, and have refrained from giving specific guidance on how large their next rate hikes will be. Traders bet the benchmark Selic will surpass 13% in 2025.

Investors are becoming more concerned about Lula’s pledges to balance the budget. Last week, the leftist president said he wants income tax exemptions beyond his campaign pledge for workers with salaries of up to 5,000 reais ($893), without giving details on how he would compensate for any loss in revenue.

Central bankers are also sounding the alarm on the need to balance the country’s budget amid an overheated economy. Gabriel Galipolo reinforced the need for a cautious stance in light of above-target inflation estimates, in comments made during his Senate confirmation last week as the institution’s new governor.

(Updates with economic activity report in third paragraph)

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.