(Bloomberg) — Chinese shares erased a drop to advance in volatile trading as investors weighed the impact of measures announced by the Finance Ministry to revive growth.

Most Read from Bloomberg

The onshore equities benchmark rallied as much as 1.7%. The yuan declined along with oil, reflecting skepticism among some traders that Beijing’s latest efforts will be enough to jumpstart growth. European stock futures were steady while US contracts slipped, as did the euro.

While China’s Finance Minister Lan Fo’an vowed more support for the real estate sector at a keenly anticipated weekend briefing, he did not produce a headline monetary stimulus figure. The focus is now turning to the next major policy briefing in the coming weeks — from the Communist Party-controlled parliament that oversees the budget — for details of more support.

“Sentiment is back to being hopeful, but will also get into a seeing-is-believing mode to await actual numbers and more details on consumption and property measures, which were lacking,” said Xin-Yao Ng, an investment director at abrdn Asia Ltd. “MOF did everything within their purview to give market hope to look forward to.”

Before the weekend briefing, money managers had been waiting for more fiscal measures to help sustain the rally sparked by the stimulus blitz that authorities unleashed in late September. Investors and analysts surveyed by Bloomberg had expected China to deploy as much as 2 trillion yuan ($283 billion) in fresh fiscal stimulus on Saturday, including potential subsidies, consumption vouchers and financial support for families with children.

The CSI 300 Index, a benchmark of onshore equities, capped its biggest weekly loss since late July on Friday, while the Australian and New Zealand dollars – proxies for China sentiment among developed market currencies – fell for two weeks running.

“There’s going to be consolidation and pullback,” Wendy Liu, chief Asia and China equity strategist at JPMorgan Chase & Co., told Bloomberg TV. “Structurally, it looks fine. Short-term, it’s not as satisfying.”

Policymakers from Thailand, the Philippines and Indonesia will hand down rate decisions ahead of the European Central Bank later this week.

The ECB will probably advance the global push for monetary easing with an interest-rate cut that policymakers had all but ruled out just a month ago.

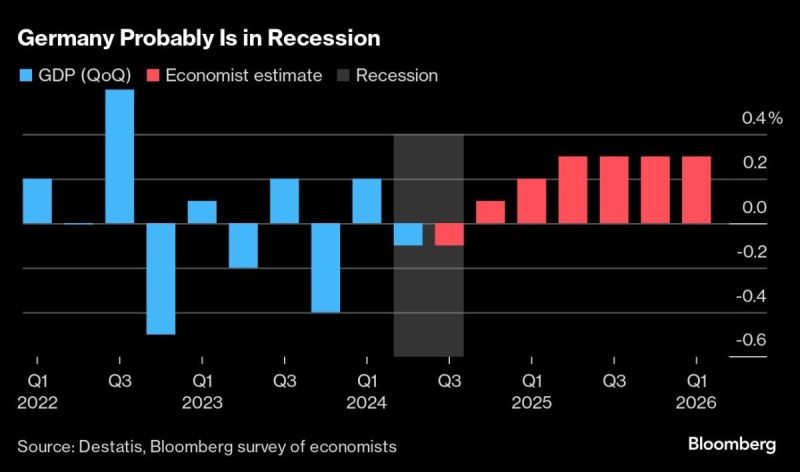

Concerns about French finances and German malaise had the euro on the back foot on Monday, while French bond futures were little changed. The region’s biggest economy is suffering a mild recession and output across the whole of 2024 will be flat, according to a Bloomberg survey.

“Clearly, softer activity data and faster disinflation have had an immediate impact on both ECB communication and markets, which are now pricing a 95% probability of a 25-basis point cut this week,” Barclays Plc strategists including Themistoklis Fiotakis wrote in a note to clients. “We view risks to European macro and interest rates as skewed to the downside, which creates scope for further euro weakness, particularly on crosses.”

The dollar advanced as traders pared expectations on the pace of Federal Reserve rate cuts. Cash Treasuries are closed in Asia due to a holiday in Japan.

Apart from the central bank policy decisions, Chinese growth and retail sales data are due this week, while inflation readings in New Zealand, Canada and the UK are expected.

Key events this week:

-

China trade balance, Monday

-

India CPI, Monday

-

UK unemployment rate and average weekly earnings, Tuesday

-

Eurozone industrial production, Tuesday

-

Canada CPI, Tuesday

-

Goldman Sachs, Bank of America, Citigroup earnings, Tuesday

-

Republican presidential candidate Donald Trump will be interviewed by Bloomberg editor-in-chief John Micklethwait at the Economic Club of Chicago, Tuesday

-

New Zealand CPI, Wednesday

-

Thailand, Philippines and Indonesia central bank interest-rate decisions, Wednesday

-

UK CPI, PPI, RPI and house price index, Wednesday

-

ASML, Morgan Stanley earnings, Wednesday

-

Australia unemployment, Thursday

-

Eurozone CPI, ECB rate decision, Thursday

-

US retail sales, jobless claims, industrial production, business inventories, Thursday

-

TSMC, Netflix earnings, Thursday

-

Japan CPI, Friday

-

China GDP, retail sales, industrial production, home prices, Friday

-

UK retail sales, Friday

Some of the main moves in markets:

Stocks

-

S&P 500 futures were little changed as of 2:40 p.m. Tokyo time

-

Nikkei 225 futures (OSE) rose 0.4%

-

Hong Kong’s Hang Seng was little changed

-

The Shanghai Composite rose 2.1%

-

Euro Stoxx 50 futures were little changed

Currencies

-

The Bloomberg Dollar Spot Index was little changed

-

The euro fell 0.1% to $1.0924

-

The Japanese yen was little changed at 149.25 per dollar

-

The offshore yuan fell 0.2% to 7.0833 per dollar

Cryptocurrencies

-

Bitcoin rose 1.7% to $63,789.47

-

Ether rose 2.1% to $2,510.87

Bonds

-

Australia’s 10-year yield advanced four basis points to 4.27%

Commodities

-

West Texas Intermediate crude fell 1% to $74.81 a barrel

-

Spot gold was little changed

This story was produced with the assistance of Bloomberg Automation.

–With assistance from Matthew Burgess and Zhu Lin.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.