United Soars on Strong Earnings, Stock Buyback News

1 hr 11 min ago

United Airlines (UAL) shares soared after the carrier unveiled plans for a $1.5 billion share buyback, its first since the pandemic, and also reported quarterly results that beat analysts’ estimates.

Late Tuesday, United reported third-quarter adjusted earnings per share (EPS) of $3.33, ahead of its own guidance and expectations of analysts polled by Visible Alpha. It also projected adjusted EPS of $2.50 to $3.00 a share in the fourth quarter, with the midpoint below the $2.92-per-share Visible Alpha estimate.

The airline said the glut in airline capacity that had plagued the industry this year had been addressed.

“As predicted, unproductive capacity left the market in mid-August, and we saw a clear inflection point in our revenue trends that propelled United to exceed Q3 expectations,” United Chief Executive Officer (CEO) Scott Kirby said.

United’s $1.5 billion share buyback marks its first repurchase plan since it suspended its program in 2020 during the COVID-19 pandemic.

The stock was up 9% in recent trading, at its highest level since early 2020.

–Nisha Goaplan

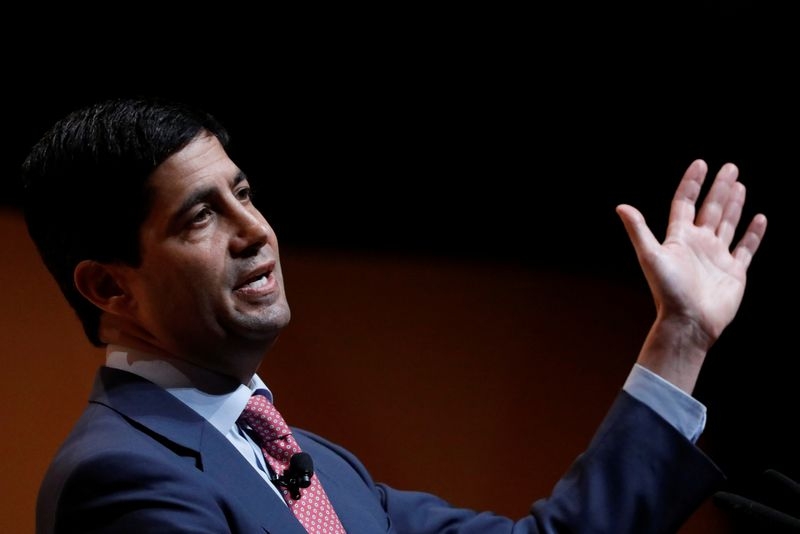

Morgan Stanley Stock Surges After Strong Results

1 hr 24 min ago

Morgan Stanley (MS) shares jumped Wednesday morning after the company became the latest bank to beat estimates for the third quarter, with revenue and profits rising year-over-year.

The bank reported $15.38 billion in revenue for the quarter, up from $13.27 billion last year and over a billion dollars more than analysts had expected, according to projections compiled by Visible Alpha. Morgan Stanley reported an increase in net interest income (NII) to $2.2 billion, up from $1.98 billion, which only some of its banking rivals have so far managed to do this quarter.1

Profits also came in well above estimates at $3.2 billion, above the $2.44 billion in net income Morgan Stanley reported last year.

Morgan Stanley shares rose more than 8% in morning trading, leaving them up roughly 30% this year, outpacing the gains for the S&P 500 over the period.

–Aaron McDade

Nvidia Levels to Watch After Tuesday's Drop

2 hr 51 min ago

Nvidia (NVDA) shares moved higher in premarket trading Wednesday after falling sharply yesterday, just a day after setting a record closing high.

The decline Tuesday came as Bloomberg reported that the Biden Administration is mulling AI chip export curbs to some Middle Eastern countries. The news tempered optimism about surging demand for Nvidia’s chips from tech giants hyperscaling their AI infrastructure amid a backdrop of tight supply.

Nvidia shares broke out above a multi-month symmetrical triangle earlier this month, though the breakout occurred on below-average volume, indicating a lack of conviction behind the move.

Investors should watch key support levels on Nvidia's chart around $125, $115, and $97, while also keeping an eye on a measured moved price target at $177. The stock was up 0.8% at $132.65 in recent premarket trading.

Read the full technical analysis piece here.

–Timothy Smith

Futures Point to Slightly Higher Open for Major Indexes

3 hr 36 min ago

Futures tied to the Dow Jones Industrial Average were up fractionally.

S&P 500 futures were up 0.1%.

Nasdaq 100 futures were up 0.2%.

Take the Next Step to Invest Advertiser Disclosure × The offers that appear in this table are from partnerships from which Investopedia receives compensation. This compensation may impact how and where listings appear. Investopedia does not include all offers available in the marketplace.