IBM Stock Sinks on Disappointing Revenue

1 hr 34 min ago

IBM (IBM) shares were down nearly 6% early Thursday and were the biggest Dow decliner after the company reported quarterly revenue that fell short of Wall Street estimates.

The company late Thursday reported third-quarter revenue of $14.97 billion, up 1% year-over-year and 2% in constant-currency terms but lower than the $15.07 billion consensus estimate of analysts polled by Visible Alpha. Infrastructure revenue fell 7% and consulting revenue remained flat.

IBM posted a net loss of $330 million, or $0.36 per share, due to a $2.7 billion pension-settlement charge. Analysts expected a profit of $1.72 billion, or $1.84 per share.

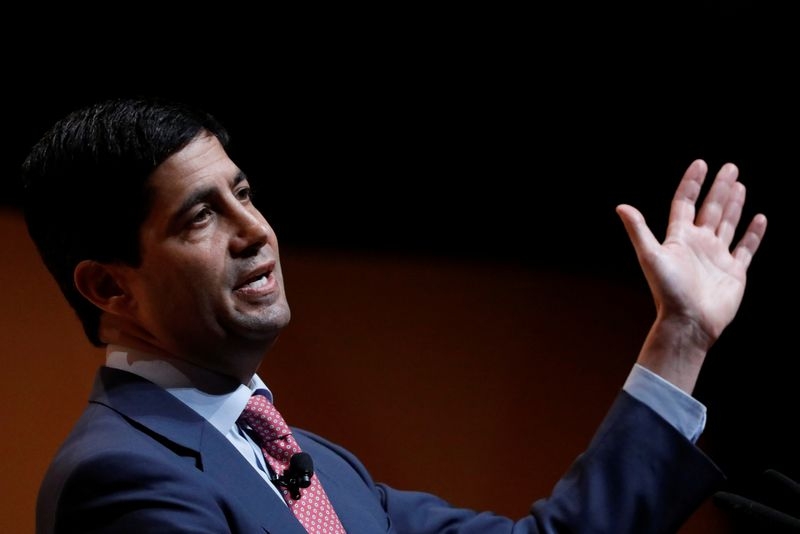

IBM Chief Executive Officer (CEO) Arvind Krishna said the group expects fourth-quarter revenue growth, in constant-currency terms, to be “consistent” with the third quarter, driven by strong software sales. Krishna said the firm’s “AI book of business now stands at more than $3 billion, up more than $1 billion quarter to quarter.”

Even after falling early Thursday, IBM shares are up nearly 35% this year.

–Nisha Gopalan

UPS Shares Surge as Shipping Giant Returns to Growth

2 hr 48 min ago

United Parcel Service (UPS) shares jumped in premarket trading as the company reported third-quarter results that came in above analysts’ expectations.

The shipping giant reported revenue of $22.2 billion, better than the $21.94 billion consensus estimate of analysts compiled by Visible Alpha. Net income came in at $1.54 billion, or $1.80 per share, above projections, which called for $1.36 billion and $1.59 per share.

Thursday’s results mark the first time in nearly two years that UPS returned to posting year-over-year revenue and profit gains, after it and shipping rival FedEx (FDX) each reported declines following peaks in shipping demand during the pandemic.

UPS shares were up 9% at $143, trading at their highest level in three months.

–Aaron McDade

Futures Tied to Major Indexes Mixed

4 hr 3 min ago

Futures tied to the Dow Jones Industrial Average were down 0.2%.

S&P 500 futures were up 0.5%.

Nasdaq 100 futures were up 0.9%.

Take the Next Step to Invest Advertiser Disclosure × The offers that appear in this table are from partnerships from which Investopedia receives compensation. This compensation may impact how and where listings appear. Investopedia does not include all offers available in the marketplace.