News

- Today's news

- US

- Politics

- World

- Tech

- Reviews and deals

- Audio

- Computing

- Gaming

- Health

- Home

- Phones

- Science

- TVs

- Climate change

- Health

- Science

- 2024 election

- Originals

- The 360

- Newsletters

Life

- Health

- COVID-19

- Fall allergies

- Health news

- Mental health

- Relax

- Sexual health

- Studies

- The Unwind

- Parenting

- Family health

- So mini ways

- Style and beauty

- It Figures

- Unapologetically

- Horoscopes

- Shopping

- Buying guides

- Food

- Travel

- Autos

- Gift ideas

- Buying guides

Entertainment

- Celebrity

- TV

- Movies

- Music

- How to Watch

- Interviews

- Videos

Finance

- My Portfolio

- News

- Latest News

- Stock Market

- Originals

- The Morning Brief

- Premium News

- Economics

- Housing

- Earnings

- Tech

- Crypto

- Biden Economy

- Markets

- Stocks: Most Actives

- Stocks: Gainers

- Stocks: Losers

- Trending Tickers

- Futures

- World Indices

- US Treasury Bonds Rates

- Currencies

- Crypto

- Top ETFs

- Top Mutual Funds

- Options: Highest Open Interest

- Options: Highest Implied Volatility

- Sectors

- Basic Materials

- Communication Services

- Consumer Cyclical

- Consumer Defensive

- Energy

- Financial Services

- Healthcare

- Industrials

- Real Estate

- Technology

- Utilities

- Research

- Screeners

- Screeners Beta

- Watchlists

- Calendar

- Stock Comparison

- Advanced Chart

- Currency Converter

- Investment Ideas

- Research Reports

- Personal Finance

- Credit Cards

- Balance Transfer Cards

- Cash-back Cards

- Rewards Cards

- Travel Cards

- Credit Card Offers

- Banking

- CD Rates

- Best HYSA

- Best Free Checking

- Student Loans

- Personal Loans

- Insurance

- Car insurance

- Mortgages

- Mortgage Refinancing

- Mortgage Calculator

- Taxes

- Videos

- Invest

- Latest News

- Editor's Picks

- Investing Insights

- Trending Stocks

- All Shows

- Morning Brief

- Opening Bid

- Wealth

- ETF Report

Sports

- Fantasy

- News

- Fantasy football

- Best Ball

- Pro Pick 'Em

- College Pick 'Em

- Fantasy baseball

- Fantasy hockey

- Fantasy basketball

- Download the app

- Daily fantasy

- NFL

- News

- Scores and schedules

- Standings

- Stats

- Teams

- Players

- Drafts

- Injuries

- Odds

- Super Bowl

- GameChannel

- Videos

- MLB

- News

- Scores and schedules

- Standings

- Stats

- Teams

- Players

- Odds

- Videos

- World Baseball Classic

- NBA

- News

- Draft

- Scores and schedules

- Standings

- Stats

- Teams

- Players

- Injuries

- Videos

- Odds

- Playoffs

- NHL

- News

- Scores and schedules

- Standings

- Stats

- Teams

- Players

- Odds

- Playoffs

- Soccer

- News

- Scores and schedules

- Premier League

- MLS

- NWSL

- Liga MX

- CONCACAF League

- Champions League

- La Liga

- Serie A

- Bundesliga

- Ligue 1

- World Cup

- College football

- News

- Scores and schedules

- Standings

- Rankings

- Stats

- Teams

-

- MMA

- WNBA

- Sportsbook

- NCAAF

- Tennis

- Golf

- NASCAR

- NCAAB

- NCAAW

- Boxing

- USFL

- Cycling

- Motorsports

- Olympics

- Horse racing

- GameChannel

- Rivals

- Newsletters

- Podcasts

- Videos

- RSS

- Jobs

- Help

- World Cup

- More news

New on Yahoo

- Creators

- Games

- Tech

- Terms

- Privacy

- Your Privacy Choices

- Feedback

© 2024 All rights reserved. About our ads Advertising Careers Yahoo Finance Yahoo Finance Search query Select edition

- USEnglish

- US y LATAMEspañol

- AustraliaEnglish

- CanadaEnglish

- CanadaFrançais

- DeutschlandDeutsch

- FranceFrançais

- 香港繁中

- MalaysiaEnglish

- New ZealandEnglish

- SingaporeEnglish

- 台灣繁中

- UKEnglish

Sign in

- My Portfolio

- News

- Latest News

- Stock Market

- Originals

- The Morning Brief

- Premium News

- Economics

- Housing

- Earnings

- Tech

- Crypto

- Biden Economy

- Markets

- Stocks: Most Actives

- Stocks: Gainers

- Stocks: Losers

- Trending Tickers

- Futures

- World Indices

- US Treasury Bonds Rates

- Currencies

- Crypto

- Top ETFs

- Top Mutual Funds

- Options: Highest Open Interest

- Options: Highest Implied Volatility

- Sectors

- Basic Materials

- Communication Services

- Consumer Cyclical

- Consumer Defensive

- Energy

- Financial Services

- Healthcare

- Industrials

- Real Estate

- Technology

- Utilities

- Research

- Screeners

- Screeners Beta

- Watchlists

- Calendar

- Stock Comparison

- Advanced Chart

- Currency Converter

- Investment Ideas

- Research Reports

- Personal Finance

- Credit Cards

- Balance Transfer Cards

- Cash-back Cards

- Rewards Cards

- Travel Cards

- Credit Card Offers

- Banking

- CD Rates

- Best HYSA

- Best Free Checking

- Student Loans

- Personal Loans

- Insurance

- Car insurance

- Mortgages

- Mortgage Refinancing

- Mortgage Calculator

- Taxes

- Videos

- Invest

- Latest News

- Editor's Picks

- Investing Insights

- Trending Stocks

- All Shows

- Morning Brief

- Opening Bid

- Wealth

- ETF Report

Upgrade to Premium Dollar braces for US inflation data and several Fed speakers FILE PHOTO: U.S. one hundred dollar notes are seen in this picture illustration taken in Seoul · Reuters Wayne Cole Sun, Nov 10, 2024, 6:55 PM 3 min read

By Wayne Cole

SYDNEY (Reuters) – The dollar started in a cautious mood on Monday as markets braced for U.S. inflation data and a throng of Federal Reserve speakers this week, while the yuan nursed a hangover from Beijing's latest underwhelming stimulus package.

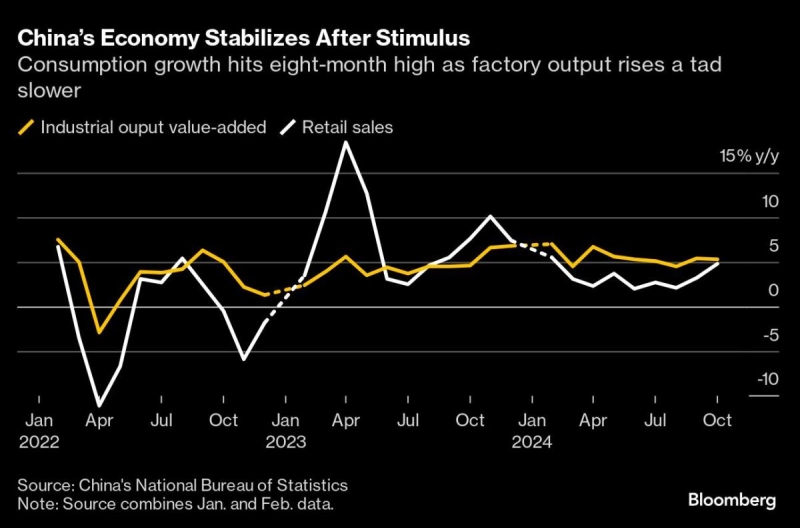

Highlighting the weak background in China, data out over the weekend showed consumer prices rose at the slowest pace in four months in October while producer price deflation deepened.

Reports on retail sales and industrial output due Friday should show whether Beijing's various attempts at stimulus are having any real effect on demand.

Disappointment at the latest package had seen the Australian and New Zealand dollars slide on Friday as both countries are major exporters to China.

The dollar stood at 7.1970 yuan, having jumped 0.7% on Friday, and looks set to again test the 7.2000 barrier.

Moves were minor overall, with U.S. bond markets on holiday though stocks and futures are open. The dollar was up 0.1% on the yen at 152.90, having been dragged off last week's top of 154.70 by the risk of Japanese intervention.

The dollar index was a fraction firmer at 105.00, after gaining 0.6% last week mainly against the euro.

The single currency was stuck at $1.0711, having shed 1% last week to as low as $1.0683. Support now lies around $1.0667 and $1.0601.

Political uncertainty remained a drag as German Chancellor Olaf Scholz said he would be willing to call a vote of confidence before Christmas, paving the way for snap elections following the collapse of his governing coalition.

FED RESTRAINED

The euro has been pressured by U.S. President-elect Donald Trump's proposals for tariffs on imports, which could hurt European exports and risk a global trade war.

Analysts also assume Trump's policies would put upward pressure on U.S. inflation and bond yields, while limiting the Federal Reserve's scope to ease policy.

"Given this, we still expect that the Fed will cut another 25bp at the December meeting, but thereafter will only cut once per quarter, in contrast to our previous forecast for a 25bp cut every meeting," said JPMorgan economist Michael Feroli.

"In addition, we now look for the Fed to conclude once it reaches 3.5%, versus our earlier forecast for a 3.0% terminal rate."

A host of Fed officials speak this week, including Chair Jerome Powell on Thursday, so there will be plenty of guidance on the outlook for rates.

Data will also be influential as U.S. consumer prices are due Thursday and a core reading above the 0.3% forecasted would further reduce the chance of a December easing.

All this was seen as bullish for the dollar over the long term, though it was yet to be seen what Trump's policies would actually be in practice.

His support of cryptocurrencies has been enough to propel Bitcoin above $80,000 for the first time as investors wager on more favourable regulation.

(Reporting by Wayne Cole; Editing by David Gregorio)

Terms and Privacy Policy Your Privacy Choices