News

- Today's news

- US

- Politics

- World

- Tech

- Reviews and deals

- Audio

- Computing

- Gaming

- Health

- Home

- Phones

- Science

- TVs

- Climate change

- Health

- Science

- 2024 election

- Originals

- The 360

- Newsletters

Life

- Health

- COVID-19

- Fall allergies

- Health news

- Mental health

- Relax

- Sexual health

- Studies

- The Unwind

- Parenting

- Family health

- So mini ways

- Style and beauty

- It Figures

- Unapologetically

- Horoscopes

- Shopping

- Buying guides

- Food

- Travel

- Autos

- Gift ideas

- Buying guides

Entertainment

- Celebrity

- TV

- Movies

- Music

- How to Watch

- Interviews

- Videos

Finance

- My Portfolio

- News

- Latest News

- Stock Market

- Originals

- The Morning Brief

- Premium News

- Economics

- Housing

- Earnings

- Tech

- Crypto

- Biden Economy

- Markets

- Stocks: Most Actives

- Stocks: Gainers

- Stocks: Losers

- Trending Tickers

- Futures

- World Indices

- US Treasury Bonds Rates

- Currencies

- Crypto

- Top ETFs

- Top Mutual Funds

- Options: Highest Open Interest

- Options: Highest Implied Volatility

- Sectors

- Basic Materials

- Communication Services

- Consumer Cyclical

- Consumer Defensive

- Energy

- Financial Services

- Healthcare

- Industrials

- Real Estate

- Technology

- Utilities

- Research

- Screeners

- Screeners Beta

- Watchlists

- Calendar

- Stock Comparison

- Advanced Chart

- Currency Converter

- Investment Ideas

- Research Reports

- Personal Finance

- Credit Cards

- Balance Transfer Cards

- Cash-back Cards

- Rewards Cards

- Travel Cards

- Credit Card Offers

- Banking

- CD Rates

- Best HYSA

- Best Free Checking

- Student Loans

- Personal Loans

- Insurance

- Car insurance

- Mortgages

- Mortgage Refinancing

- Mortgage Calculator

- Taxes

- Videos

- Invest

- Latest News

- Editor's Picks

- Investing Insights

- Trending Stocks

- All Shows

- Morning Brief

- Opening Bid

- Wealth

- ETF Report

Sports

- Fantasy

- News

- Fantasy football

- Best Ball

- Pro Pick 'Em

- College Pick 'Em

- Fantasy baseball

- Fantasy hockey

- Fantasy basketball

- Download the app

- Daily fantasy

- NFL

- News

- Scores and schedules

- Standings

- Stats

- Teams

- Players

- Drafts

- Injuries

- Odds

- Super Bowl

- GameChannel

- Videos

- MLB

- News

- Scores and schedules

- Standings

- Stats

- Teams

- Players

- Odds

- Videos

- World Baseball Classic

- NBA

- News

- Draft

- Scores and schedules

- Standings

- Stats

- Teams

- Players

- Injuries

- Videos

- Odds

- Playoffs

- NHL

- News

- Scores and schedules

- Standings

- Stats

- Teams

- Players

- Odds

- Playoffs

- Soccer

- News

- Scores and schedules

- Premier League

- MLS

- NWSL

- Liga MX

- CONCACAF League

- Champions League

- La Liga

- Serie A

- Bundesliga

- Ligue 1

- World Cup

- College football

- News

- Scores and schedules

- Standings

- Rankings

- Stats

- Teams

-

- MMA

- WNBA

- Sportsbook

- NCAAF

- Tennis

- Golf

- NASCAR

- NCAAB

- NCAAW

- Boxing

- USFL

- Cycling

- Motorsports

- Olympics

- Horse racing

- GameChannel

- Rivals

- Newsletters

- Podcasts

- Videos

- RSS

- Jobs

- Help

- World Cup

- More news

New on Yahoo

- Creators

- Games

- Tech

- Terms

- Privacy

- Your Privacy Choices

- Feedback

© 2024 All rights reserved. About our ads Advertising Careers Yahoo Finance Yahoo Finance Search query Select edition

- USEnglish

- US y LATAMEspañol

- AustraliaEnglish

- CanadaEnglish

- CanadaFrançais

- DeutschlandDeutsch

- FranceFrançais

- 香港繁中

- MalaysiaEnglish

- New ZealandEnglish

- SingaporeEnglish

- 台灣繁中

- UKEnglish

Sign in

- My Portfolio

- News

- Latest News

- Stock Market

- Originals

- The Morning Brief

- Premium News

- Economics

- Housing

- Earnings

- Tech

- Crypto

- Biden Economy

- Markets

- Stocks: Most Actives

- Stocks: Gainers

- Stocks: Losers

- Trending Tickers

- Futures

- World Indices

- US Treasury Bonds Rates

- Currencies

- Crypto

- Top ETFs

- Top Mutual Funds

- Options: Highest Open Interest

- Options: Highest Implied Volatility

- Sectors

- Basic Materials

- Communication Services

- Consumer Cyclical

- Consumer Defensive

- Energy

- Financial Services

- Healthcare

- Industrials

- Real Estate

- Technology

- Utilities

- Research

- Screeners

- Screeners Beta

- Watchlists

- Calendar

- Stock Comparison

- Advanced Chart

- Currency Converter

- Investment Ideas

- Research Reports

- Personal Finance

- Credit Cards

- Balance Transfer Cards

- Cash-back Cards

- Rewards Cards

- Travel Cards

- Credit Card Offers

- Banking

- CD Rates

- Best HYSA

- Best Free Checking

- Student Loans

- Personal Loans

- Insurance

- Car insurance

- Mortgages

- Mortgage Refinancing

- Mortgage Calculator

- Taxes

- Videos

- Invest

- Latest News

- Editor's Picks

- Investing Insights

- Trending Stocks

- All Shows

- Morning Brief

- Opening Bid

- Wealth

- ETF Report

Upgrade to Premium Stocks Get Hit as Powell’s Remarks Curb Fed Wagers: Markets Wrap Stocks Get Hit as Powell’s Remarks Curb Fed Wagers: Markets Wrap · Bloomberg Rita Nazareth Thu, Nov 14, 2024, 4:18 PM 7 min read

(Bloomberg) — Stocks extended losses after Jerome Powell signaled the Federal Reserve is in no rush to cut rates as the economy is holding up.

Most Read from Bloomberg

-

Under Trump, Prepare for New US Transportation Priorities

-

Zimbabwe City of 700,000 at Risk of Running Dry by Year-End

-

Saudi Neom Gets $3 Billion Loan Guarantee From Italy Export Credit Agency Sace

-

NYC Congestion Pricing Plan With $9 Toll to Start in January

-

The Urban-Rural Divide Over Highway Expansion and Emissions

The equity market closed near session lows, US two-year yields spiked and the dollar climbed after Powell’s remarks. Traders dialed back bets on a December rate reduction to around 55% — from 80% in the previous day.

“Powell’s speech was hawkish,” said Neil Dutta at Renaissance Macro Research. “I think they will still cut in December since policy remains restrictive and they want to get to a neutral setting. That said, on the economy, I think Powell (and the broader consensus) is complacent. There is more downside risk in the near-term than is being appreciated.”

To Quincy Krosby at LPL Financial, while it’s expected that the last mile towards price stability will be bumpy, Powell reminded markets that once again the Fed will not deliver the series of rate cuts they want, unless of course the labor market deteriorates.

Several policymakers have urged a cautious approach to further rate cuts in comments this week, in light of a strong economy, lingering inflation concerns and broad uncertainty. Their comments come at a time when the equity market is showing signs of fatigue following a post-election surge that spurred calls for a pause, with several measures highlighting “stretched” trader optimism.

The S&P 500 dropped 0.6%. The Nasdaq 100 slipped 0.7%. The Dow Jones Industrial Average lost 0.5%. Automakers like Tesla Inc. and Rivian Automotive Inc. slumped as Reuters reported President-elect Donald Trump plans to eliminate the $7,500 consumer tax credit for electric-vehicle purchases. Walt Disney Co. jumped on a profit beat.

Treasury two-year yields rose seven basis points to 4.36%. The Bloomberg Dollar Spot Index added 0.3%.

Equities lost steam after a strong post-election rally that reflected optimism that Trump’s agenda would support corporate growth.

While many investors seem reluctant to sell just yet, caution is warranted, according to Fawad Razaqzada at City Index and Forex.com. The S&P 500 is clearly overbought by several metrics, signaling that a correction or consolidation may be due, he noted.

“Although a full-fledged selloff appears unlikely without the index first breaking multiple support levels, current conditions suggest a modest pullback may be in order for the S&P 500,” Razaqzada added. “For seasoned traders, a short-term pullback could offer buying opportunities, though a clear trend reversal signal has yet to emerge.”

The S&P 500 may reach 6,100 before year-end amid enthusiasm over the Republican sweep of the White House and Congress, but pushing beyond that level may be challenging in the near term, according to Mike Wilson at Morgan Stanley. The gauge closed at 5,949.17 Thursday.

The market may be pressured by any backup in benchmark borrowing rates, or expectations of less aggressive monetary easing by the Fed, Wilson said in an interview to Bloomberg Television, adding that pullbacks will probably be seen as buying opportunities.

The US equity benchmark is likely to grind higher into year-end — with a market melt-up possible, but not a base case, according to UBS Group AG strategists including Maxwell Grinacoff.

With Commodity Trading Advisor funds already positioned max long, marginal upside from option dealer short gamma positioning and the Trump re-election well priced, a market grind higher is a more likely scenario, they noted.

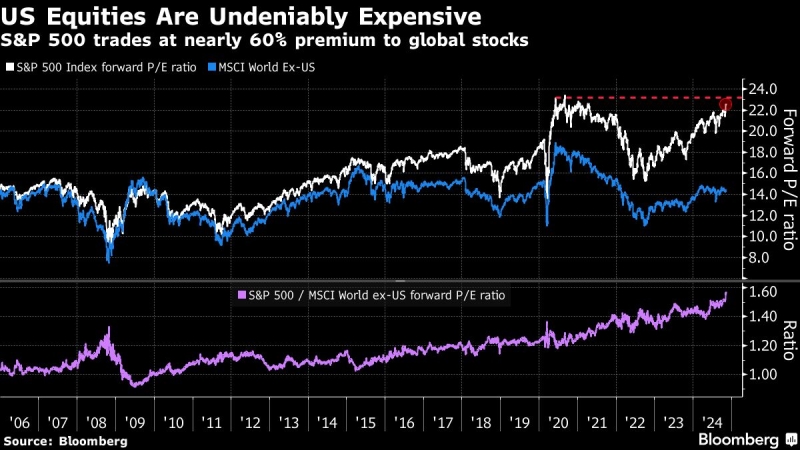

Societe Generale SA strategists including Andrew Lapthorne see US equities as “undeniably expensive” but say valuation conversations “are increasingly rare.” The US represents about 74% of the MSCI World market cap, also a record high. “This is almost entirely down to the valuation premium, without which the US would be closer to 50% of MSCI World.”

While the stock market has mostly ignored the recent move higher in bond yields as economic growth holds up, it’s still something worth keeping an eye on.

Higher odds of a December Fed cut increase the chances that an already firm economy will strengthen further, according to Dennis DeBusschere at 22V Research. Economic data needs to stay consistent with growth of around 2.5% (or lower) for 10-year yields to stay where they are, he added.

“Our call is 10-year yields remain around current levels, but growth above 2.5% will lead to higher yields and a potential break above 4.55%,” DeBusschere noted. “That level of yield would be a headwind for small caps, debt risk names, and other riskier factors as it happens.”

In fact, while Trump’s victory in the US election propelled the Russell 2000 of smaller firms back toward levels last seen three years ago, an overhang from interest rates remain a hurdle.

Morgan Stanley’s Wilson this week said a key risk for small caps present now that was not in 2016 is the market’s negative correlation to rates, while it was positive eight years ago when Trump first captured the White House. The Russell 2000 rose 60% during Trump’s first term, though still trailing the S&P 500 and the Nasdaq 100 indexes.

“In other words, in today’s later-cycle environment, these cohorts’ adverse sensitivity to rising rates is greater than it was in that period,” he warned clients in a note. “Should rates see more upside post the election, these cohorts could be held back from a relative performance standpoint.”

The potential for renewed inflation is being considered, though even hotter US data is unlikely to derail the risk-on mood since there’s another inflation print in December ahead of the next Fed meeting, according to JPMorgan Chase & Co.’s Andrew Tyler.

Corporate Highlights:

-

Hims & Hers Health Inc. sank after Amazon.com Inc. said it would start marketing drugs to fight hair loss, an important component of the telehealth company’s business.

-

Meta Platforms Inc. was hit with a €798 million ($841 million) fine by European Union regulators by tying its Facebook Marketplace service to its sprawling social network, the US tech giant’s first ever penalty for EU antitrust violations.

-

ASML Holding NV, the Dutch maker of advanced chip-making machines that are critical to global supply chains, reaffirmed its long-term revenue outlook as it bets on an artificial intelligence-driven boom in semiconductor demand.

-

Ford Motor Co. agreed to a $165 million civil penalty to settle allegations the company failed to recall cars with defective rearview cameras in a timely manner, the second largest fine ever levied by the National Highway Traffic Safety Administration.

-

Merck & Co. licensed an experimental cancer antibody from a closely held Chinese company in a deal worth $588 million upfront, plus as much as $2.7 billion in milestone payments.

-

General Mills Inc., known for cereal brands such as Cheerios, made its fifth acquisition in the pet food sector since 2018 by buying the North American unit of Whitebridge Pet Brands in a deal valued at $1.45 billion.

-

Capri Holdings Ltd and Tapestry Inc. scrapped their $8.5 billion plan to merge after a court order froze the proposed combination of the US fashion companies due to antitrust regulators’ objections.

-

JD.com Inc.’s quarterly revenue rose 5.1%, a moderate expansion that suggests Chinese consumers are only cautiously spending again as Beijing tries to revitalize the economy.

Key events this week:

-

China retail sales, industrial production, Friday

-

US retail sales, Empire manufacturing, industrial production, Friday

Some of the main moves in markets:

Stocks

-

The S&P 500 fell 0.6% as of 4 p.m. New York time

-

The Nasdaq 100 fell 0.7%

-

The Dow Jones Industrial Average fell 0.5%

-

The MSCI World Index fell 0.5%

Currencies

-

The Bloomberg Dollar Spot Index rose 0.3%

-

The euro fell 0.4% to $1.0522

-

The British pound fell 0.4% to $1.2658

-

The Japanese yen fell 0.5% to 156.29 per dollar

Cryptocurrencies

-

Bitcoin fell 1.1% to $87,670.54

-

Ether fell 1.7% to $3,100.76

Bonds

-

The yield on 10-year Treasuries declined one basis point to 4.44%

-

Germany’s 10-year yield declined five basis points to 2.34%

-

Britain’s 10-year yield declined four basis points to 4.48%

Commodities

-

West Texas Intermediate crude rose 0.2% to $68.58 a barrel

-

Spot gold fell 0.2% to $2,567.40 an ounce

This story was produced with the assistance of Bloomberg Automation.

Most Read from Bloomberg Businessweek

-

Elon Musk Has a New Project to Run: Trump’s Government

-

A Guide to Trump’s Tariff Plans: Expect High Drama and a Bumpy Rollout

-

North Dakota Wants Your Carbon, But Not Your Climate Science

-

Oh, the Irony. Trump’s Triumph and the Next Four Years

-

For Europe, the Next US President Is a Shock—and a Catalyst for Change

©2024 Bloomberg L.P.

Terms and Privacy Policy Your Privacy Choices