News

- Today's news

- US

- Politics

- World

- Tech

- Reviews and deals

- Audio

- Computing

- Gaming

- Health

- Home

- Phones

- Science

- TVs

- Climate change

- Health

- Science

- 2024 election

- Originals

- The 360

- Newsletters

Life

- Health

- COVID-19

- Fall allergies

- Health news

- Mental health

- Relax

- Sexual health

- Studies

- The Unwind

- Parenting

- Family health

- So mini ways

- Style and beauty

- It Figures

- Unapologetically

- Horoscopes

- Shopping

- Buying guides

- Food

- Travel

- Autos

- Gift ideas

- Buying guides

Entertainment

- Celebrity

- TV

- Movies

- Music

- How to Watch

- Interviews

- Videos

Finance

- My Portfolio

- News

- Latest News

- Stock Market

- Originals

- The Morning Brief

- Premium News

- Economics

- Housing

- Earnings

- Tech

- Crypto

- Biden Economy

- Markets

- Stocks: Most Actives

- Stocks: Gainers

- Stocks: Losers

- Trending Tickers

- Futures

- World Indices

- US Treasury Bonds Rates

- Currencies

- Crypto

- Top ETFs

- Top Mutual Funds

- Options: Highest Open Interest

- Options: Highest Implied Volatility

- Sectors

- Basic Materials

- Communication Services

- Consumer Cyclical

- Consumer Defensive

- Energy

- Financial Services

- Healthcare

- Industrials

- Real Estate

- Technology

- Utilities

- Research

- Screeners

- Screeners Beta

- Watchlists

- Calendar

- Stock Comparison

- Advanced Chart

- Currency Converter

- Investment Ideas

- Research Reports

- Personal Finance

- Credit Cards

- Balance Transfer Cards

- Cash-back Cards

- Rewards Cards

- Travel Cards

- Credit Card Offers

- Banking

- CD Rates

- Best HYSA

- Best Free Checking

- Student Loans

- Personal Loans

- Insurance

- Car insurance

- Mortgages

- Mortgage Refinancing

- Mortgage Calculator

- Taxes

- Videos

- Invest

- Latest News

- Editor's Picks

- Investing Insights

- Trending Stocks

- All Shows

- Morning Brief

- Opening Bid

- Wealth

- ETF Report

Sports

- Fantasy

- News

- Fantasy football

- Best Ball

- Pro Pick 'Em

- College Pick 'Em

- Fantasy baseball

- Fantasy hockey

- Fantasy basketball

- Download the app

- Daily fantasy

- NFL

- News

- Scores and schedules

- Standings

- Stats

- Teams

- Players

- Drafts

- Injuries

- Odds

- Super Bowl

- GameChannel

- Videos

- MLB

- News

- Scores and schedules

- Standings

- Stats

- Teams

- Players

- Odds

- Videos

- World Baseball Classic

- NBA

- News

- Draft

- Scores and schedules

- Standings

- Stats

- Teams

- Players

- Injuries

- Videos

- Odds

- Playoffs

- NHL

- News

- Scores and schedules

- Standings

- Stats

- Teams

- Players

- Odds

- Playoffs

- Soccer

- News

- Scores and schedules

- Premier League

- MLS

- NWSL

- Liga MX

- CONCACAF League

- Champions League

- La Liga

- Serie A

- Bundesliga

- Ligue 1

- World Cup

- College football

- News

- Scores and schedules

- Standings

- Rankings

- Stats

- Teams

-

- MMA

- WNBA

- Sportsbook

- NCAAF

- Tennis

- Golf

- NASCAR

- NCAAB

- NCAAW

- Boxing

- USFL

- Cycling

- Motorsports

- Olympics

- Horse racing

- GameChannel

- Rivals

- Newsletters

- Podcasts

- Videos

- RSS

- Jobs

- Help

- World Cup

- More news

New on Yahoo

- Creators

- Games

- Tech

- Terms

- Privacy

- Your Privacy Choices

- Feedback

© 2024 All rights reserved. About our ads Advertising Careers Yahoo Finance Yahoo Finance Search query Select edition

- USEnglish

- US y LATAMEspañol

- AustraliaEnglish

- CanadaEnglish

- CanadaFrançais

- DeutschlandDeutsch

- FranceFrançais

- 香港繁中

- MalaysiaEnglish

- New ZealandEnglish

- SingaporeEnglish

- 台灣繁中

- UKEnglish

Sign in

- My Portfolio

- News

- Latest News

- Stock Market

- Originals

- The Morning Brief

- Premium News

- Economics

- Housing

- Earnings

- Tech

- Crypto

- Biden Economy

- Markets

- Stocks: Most Actives

- Stocks: Gainers

- Stocks: Losers

- Trending Tickers

- Futures

- World Indices

- US Treasury Bonds Rates

- Currencies

- Crypto

- Top ETFs

- Top Mutual Funds

- Options: Highest Open Interest

- Options: Highest Implied Volatility

- Sectors

- Basic Materials

- Communication Services

- Consumer Cyclical

- Consumer Defensive

- Energy

- Financial Services

- Healthcare

- Industrials

- Real Estate

- Technology

- Utilities

- Research

- Screeners

- Screeners Beta

- Watchlists

- Calendar

- Stock Comparison

- Advanced Chart

- Currency Converter

- Investment Ideas

- Research Reports

- Personal Finance

- Credit Cards

- Balance Transfer Cards

- Cash-back Cards

- Rewards Cards

- Travel Cards

- Credit Card Offers

- Banking

- CD Rates

- Best HYSA

- Best Free Checking

- Student Loans

- Personal Loans

- Insurance

- Car insurance

- Mortgages

- Mortgage Refinancing

- Mortgage Calculator

- Taxes

- Videos

- Invest

- Latest News

- Editor's Picks

- Investing Insights

- Trending Stocks

- All Shows

- Morning Brief

- Opening Bid

- Wealth

- ETF Report

Upgrade to Premium Stocks Slide as Fed Rate-Cut Bets Pared Back: Markets Wrap

1 / 2

Asian Stocks Gain on China Recovery, Weaker Dollar: Markets Wrap

Richard Henderson and Margaryta Kirakosian Fri, Nov 15, 2024, 3:36 AM 3 min read

In This Article:

^GSPC

(Bloomberg) — European equities and US futures fell after Jerome Powell indicated the Federal Reserve was in no rush to cut interest rates.

Most Read from Bloomberg

-

Under Trump, Prepare for New US Transportation Priorities

-

Zimbabwe City of 700,000 at Risk of Running Dry by Year-End

-

Saudi Neom Gets $3 Billion Loan Guarantee From Italy Export Credit Agency Sace

-

The Urban-Rural Divide Over Highway Expansion and Emissions

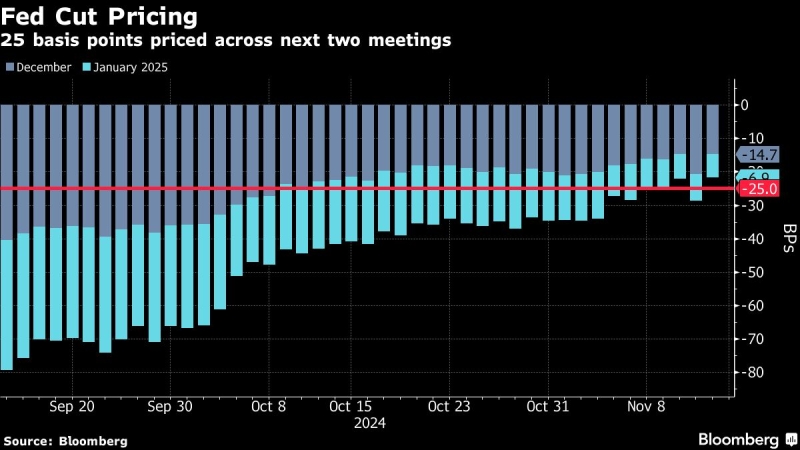

The Stoxx 600 slipped 0.7%, on track for its fourth weekly drop, and S&P 500 futures pointed to a second day of declines on Wall Street. Yields on two-year Treasuries steadied after jumping in the previous session as traders pared back their expectations for an interest-rate reduction from the Fed in December.

A gauge of the dollar was set to rise about 1.4% for the week, having hit a two-year high on Thursday. The greenback has rallied in the wake of Donald Trump’s election win, and the latest boost came from Chair Powell’s comments that the Fed may take its time easing policy. More clarity on the Fed’s path could emerge later Friday as the US releases retail sales data and a host of Fed officials are set to speak.

“Admittedly the US dollar is pricing in a lot of Trump policy without timing or implementation detail, meaning it’s more about embracing a sweeping ‘narrative,’” said Richard Franulovich, head of FX strategy at Westpac Banking Corp. in Sydney. “Markets risk over-egging this story.”

Powell’s remarks that the Fed is not in a hurry to cut rates given the strength of the economy prompted traders to pare back expectations for a December rate cut, taking odds to less than 60% from roughly 80% a day earlier.

Several Fed policymakers have urged a cautious approach to easing, given the strong economy, lingering inflation concerns and broad uncertainty. Their comments come at a time when the equity market is showing signs of fatigue following a post-election surge that spurred calls for a pause, with several measures highlighting “stretched” trader optimism.

In Asia, MSCI’s regional index headed for its first gain this week, while China’s CSI 300 Index dropped despite signs of resilience in the nation’s economy. A monthly activity report showed retail sales expanded at the strongest pace in eight months.

Japan’s yen reversed losses after Finance Minister Katsunobu Kato said authorities are monitoring the forex market.

In commodities, oil headed for a weekly drop, weighed down by the impact of a stronger dollar and concerns the global market will flip to a glut next year. Gold held near a two-month low.

Key events this week:

-

US retail sales, Empire manufacturing, industrial production, Friday

Some of the main moves in markets:

Stocks

-

The Stoxx Europe 600 fell 0.7% as of 8:19 a.m. London time

-

S&P 500 futures fell 0.6%

-

Nasdaq 100 futures fell 0.9%

-

Futures on the Dow Jones Industrial Average fell 0.6%

-

The MSCI Asia Pacific Index rose 0.3%

-

The MSCI Emerging Markets Index rose 0.1%

Currencies

-

The Bloomberg Dollar Spot Index fell 0.2%

-

The euro rose 0.2% to $1.0556

-

The Japanese yen rose 0.3% to 155.75 per dollar

-

The offshore yuan rose 0.2% to 7.2379 per dollar

-

The British pound was little changed at $1.2661

Cryptocurrencies

-

Bitcoin fell 0.6% to $87,685.14

-

Ether fell 2.6% to $3,038.95

Bonds

-

The yield on 10-year Treasuries advanced one basis point to 4.45%

-

Germany’s 10-year yield advanced one basis point to 2.35%

-

Britain’s 10-year yield advanced two basis points to 4.50%

Commodities

-

Brent crude fell 1.5% to $71.47 a barrel

-

Spot gold was little changed

This story was produced with the assistance of Bloomberg Automation.

–With assistance from Winnie Hsu and Matthew Burgess.

Most Read from Bloomberg Businessweek

-

Elon Musk Has a New Project to Run: Trump’s Government

-

North Dakota Wants Your Carbon, But Not Your Climate Science

-

Martha Stewart’s Empire Monetized More Than Just Domesticity

-

Trump Aims a ‘Wrecking Ball’ at Climate Policy

-

Oh, the Irony. Trump’s Triumph and the Next Four Years

©2024 Bloomberg L.P.

Terms and Privacy Policy Your Privacy Choices