On September 18, the Securities and Exchange Commission (SEC or the Commission) adopted amendments to Rule 612 (Tick Sizes) and Rule 610 (Access Fees) under Regulation NMS under the Securities Exchange Act of 1934, as amended (Regulation NMS).1 The SEC also added and amended definitions and other rules under Regulation NMS to address round-lot and odd-lot sizing and dissemination. We address each category of revisions below and highlight at the outset that the SEC did not adopt the controversial provision that would have prevented market centers from executing orders at prices less than the current or revised tick sizes. That is, the minimum tick size continues to address only the minimum price increment at which a market center can publish a quotation for a security. This is significant, as adopting such a prohibition would have prevented broker-dealers and other market centers from providing price improvement at prices finer than the quotation tick sizes.

The SEC also took a measured approach to other aspects of the rule. As explained more fully below, the Commission adopted only one additional minimum quotation size (rather than the three proposed), narrowed the scope of securities that might be subject to the smaller minimum quotation size, reduced the frequency with which primary listing exchanges must calculate tick sizes and round-lot sizes, and expanded the amount of data to be evaluated for these calculations from one month’s worth to three months’ worth.

Tick Sizes/Minimum Pricing Increments

Rule 612 of Regulation NMS regulates the price increments (that is, the “tick size”) at which a market center can display a quotation and at which a broker-dealer can accept, rank, or display orders or indications of interest in NMS stocks. Currently, for NMS stocks priced at or above $1.00 per share, broker-dealers and market centers can accept orders or quote in one-penny ($0.01) price increments and at a much smaller increment ($0.0001) for NMS stocks priced less than $1.00 per share.

The SEC and other market participants had observed that many stocks were “tick constrained” — that is, bids, offers, and other orders in those stocks might regularly allow for quotation spreads narrower than $0.01, but the penny spread requirement of Rule 612 constrained such narrower quoting. Determining the “right” quote size for a security can be complicated: on the one hand, a narrower spread reduces transaction costs for investors. On the other hand, too narrow a quotation spread allows other market participants to “step ahead” of a quotation — that is, obtain better priority — by entering an order that is priced only slightly better. Obtaining priority by quoting for an economically insignificantly better price disincentivizes those offering liquidity or price improvement to the market. Stated simply, a market participant has little incentive to expose its order to the market if another participant can easily get better priority over that order at an insignificant cost. Accordingly, the Commission sought to balance the two competing concerns of spread size and fear of stepping ahead.

Tick sizes are also relevant in the competition between exchange and non-exchange trading venues. Due to their market structure, exchanges generally execute orders at the prices they quote, but cannot execute at prices within the quoted spread. Narrower spreads provide better opportunities for exchanges to execute at the higher bids or lower offers represented by those narrower spreads. In short, narrower spreads allow exchange venues to be more competitive with off-exchange venues.

In December 2022, the SEC proposed to add three minimum tick sizes for NMS stocks priced $1.00 or more: one-tenth of a cent ($0.001), two-tenths of a cent ($0.002), and five-tenths (or one-half) of a cent ($0.005). Public comment suggested that this proposal was too complicated and the smaller price increment of $0.001 might also have been too small, thereby facilitating stepping ahead.

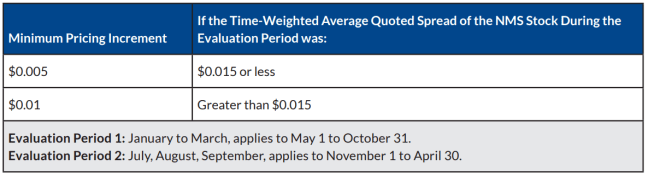

The adopted rule provides for only one new tick size for certain NMS stocks priced at or above $1.00 per share: $0.005. This half-penny minimum quotation size will apply for those NMS stocks priced at or above $1 that have a “time-weighted average quoted spread” (a metric defined in the rule) of $0.015 during a three-month Evaluation Period (as described in the table below) occurring twice a year.[1] “Time-weighted average quoted spread” seeks to estimate tick constraint and identify those securities that are quoted on average at close to a one-cent spread. Specifically, under the revised rule, primary listing exchanges must calculate the time-weighted average spread over the months of January, February, and March and July, August, and September. The results of the first (Q1) calculation determines which securities are subject to the half-penny tick size for the business days between May 1 and October 31 of that year. The results of the second (Q3) calculation determines which securities are subject to the half-penny tick size for the business days between November 1 of that year and April 30 of the following year.

The following chart shows the applicable tick sizes and calculations:

The SEC’s policy rationale for adopting these amendments is that they relax existing restrictions on tick sizes, which should reduce transaction costs and provide for better price discovery for certain NMS stocks. Additionally, smaller tick sizes for NMS stocks that merit them should improve liquidity, competition, and price efficiency.

Access Fees

Securities exchanges generally charge access fees to those who take liquidity and rebate a portion of that access fee to those who provide liquidity. As the SEC explains, “the predominant exchange fee structure is maker-taker, in which an exchange charges a fee to liquidity takers and pays a rebate to liquidity providers, and the rebate is typically funded through the access fee.”3 Rule 610(c) of Regulation NMS limits the fee that an exchange can charge for accessing protected quotations4 pursuant to Rule 611 of Regulation NMS. Currently, the access fee is capped at 30 cents per 100 shares (or “30 mils” per share) for NMS securities priced at or above $1. The access fee is capped at 0.3% of the quotation price for NMS stocks priced below $1.

With a smaller minimum quotation size, the SEC took the opportunity to revise the access fee cap, which some market participants believed had been set too high. Like the tick size changes, the access fee amendment ultimately adopted was modified from what was originally proposed. Originally, the SEC proposed to reduce access fee caps (a) from 30 mils to 10 mils per share for NMS stocks priced at or over $1 that would have been assigned a tick size larger than $0.001 and (b) to 5 mils per share for NMS stocks priced at or over $1 that would have been assigned a $0.001 tick size. For protected quotations in NMS stocks priced under $1.00 per share, the Commission originally proposed to reduce the 0.3% fee cap to 0.05% of the quotation price.

Ultimately, the Commission adopted a more simplified reduction in access fee caps. Because it added only one tick size to Rule 612, the SEC adopted only one reduction in access fee caps, from 30 mils to 10 mils per share for protected quotations in NMS stocks priced $1.00 or more. For such quotations priced less than $1.00, the Commission reduced the access fee cap from 0.3% to 0.1% of the quotation price per share. In addition, the SEC adopted (as proposed) new Rule 612(d), requiring all exchange fees charged and all rebates paid for order execution to be determinable at the time of execution. Currently, such exchange fees are subject to complex fee schedules that apply tiered and other discounts at month-end. As a result, market participants would not necessarily know intra-month whether their broker might access a higher tier later in the month, which would adjust the fee charged for the subject order. The new rule ends this uncertainty.

Setting the revised access fee cap at 10 mils per share was somewhat controversial, with Commissioners Peirce and Uyeda questioning the manner in which 10 mils was determined, whether another rate should have been used (15 mils? 5 mils? 12 mils?) and whether the Commission should be in the rate-setting business at all. The Commissioners ultimately voted in favor of the proposal based upon a pledge (discussed below) that the SEC staff will, by May 2029, “conduct a review and study the effects of the amendments in the national market system.”5

Required Staff Review and Study

The Adopting Release requires that the Commission staff conduct a “review and study” by May 2029 of the effects of the amendments on the national market system. The details of such study are not clearly defined, but the Adopting Release provides that:

[s]uch a review and study might include, but would not be limited to, an investigation of: (i) general market quality and trading activity in reaction to the implementation of the variable tick size, (ii) the reaction of quoted spreads to the implementation of the amended access fee cap, and (iii) changes to where market participants direct order flow, e.g., to exchange versus off-exchange venues, following the implementation of the amendments.6

Compliance Dates and Timelines

The amendments described above become effective 60 days after the publication of the SEC’s Adopting Release in the Federal Register. The date by which exchanges, broker-dealers, and other market participants must comply with the rule amendments is generally in November 2025 but, in some instances, in May 2026, as described more fully below. Specifically, the Compliance Date:

- for the tick size amendments (half-penny quoting for “tick-constrained” stocks) of Rule 612 is “the first business day of November 2025,” or November 3, 2025.

- for the 10 mils per share access fee cap amendment of Rule 610 and the new requirement under Rule 612(d) that exchange fees be known at time of execution in each case, is also November 3, 2025.

- for the new round-lot definition (100 shares, 40 shares, 10 shares, or 1 share) is November 3, 2025.

- for the dissemination of “odd-lot information,” including the new BOLO data element, is six months later, to allow broker-dealers and others to program systems accordingly. These changes will take effect on “the first business day of May 2026,” or May 1, 2026.

Closing Thoughts

The tick size and access fee amendments, and the other provisions adopted, appear to reflect negotiated concessions and a reasonable approach to addressing tick-constrained securities while avoiding the complex framework originally proposed. The decision not to prevent executions at prices within the minimum quotation size is appropriate and preserves the ability of market participants to provide price improvement to investors. While there can be some lingering debate about the appropriate level to which to reduce the access fee cap and whether 10 mils is an appropriate level, the net cumulative effect of these amendments appears reasonable. The planned “review and study” of the effect of the amendments may come too late if conducted towards the outer limit of “by May 2029,” but the overall effect of the amendments should serve to narrow spreads and increase quotation transparency through sub-penny quoting, reduced round-lot sizes, and the inclusion of odd-lot information.

1 Release No. 34-101070, Regulation NMS: Minimum Pricing Increments, Access Fees, and Transparency of Better Priced Orders, U.S. Sec. Exch. Comm’n (Sept. 18, 2024), https://www.sec.gov/files/rules/final/2024/34-101070.pdf (the “Adopting Release”). 2 The SEC modified of these requirements in the final rule. For example, the SEC had originally proposed smaller tick sizes for stocks with a time-weighted average quoted spread of $0.04 (rather than $0.015). The proposal also sought to evaluate tick-sizes 4 times per year rather than twice a year and based on monthly data rather than quarterly data. 3 Adopting Release at 15. 4 A protected quotation is defined in Rule 600(b)(82) of Regulation NMS as “a protected bid or protected offer.” 17 C.F.R. § 242.600(b)(82). A protected bid or protected offer is defined as “a quotation in an NMS stock that: (i) is displayed by an automated trading center; (ii) is disseminated pursuant to an effective national market system plan; and (iii) is an automated quotation that is the best bid or best offer of a national securities exchange, or the best bid or best offer of a national securities association.” 17 C.F.R. § 242.600(b)(81) 5 Adopting Release at 288. 6 Id. (emphasis added). ©2024 Katten Muchin Rosenman LLP by: Wayne M. Aaron, Robert Bourret of Katten For more news on Rule 612 and Rule 610 of Securities Exchange Act of 1934, visit the NLR Securities SEC section.