(Bloomberg) — Israel was downgraded for the second time this year by Moody’s Ratings as the economic costs mount from almost 12 months of fighting in Gaza and an escalating conflict with Hezbollah.

Most Read from Bloomberg

Moody’s cut Israel by two notches to Baa1 from A2, the ratings company said in a statement Friday, leaving the country three steps above non-investment grade. The outlook remains negative.

The “geopolitical risk has intensified significantly further, to very high levels, with material negative consequences for Israel’s creditworthiness in both the near and longer term,” Moody’s said in an unscheduled announcement. “The intensity of the conflict between Israel and Hezbollah has increased significantly in recent days.”

There’s little sign the war against Hamas is coming to an end, even if the intensity of fighting has eased. Israel has ramped up hostilities against Hezbollah, a Lebanon-based militant group, significantly in the past two weeks, and fears are mounting about a potential ground invasion and regional conflict.

The US, France and Arab states are frantically stepping up diplomatic efforts to avoid that scenario.

Yali Rothenberg, the Finance Ministry’s General Accountant, called the downgrade “excessive and unjustified.”

“The intensity of the rating action taken does not match the fiscal and macroeconomic data of the Israeli economy,” he said. “It is clear that the war on the various fronts exacts a price from the Israeli economy, but there is no justification for the rating company’s decision.”

Moody’s decision was made even before Israel struck Hezbollah’s headquarters in southern Beirut on Friday in the heaviest attack on the Lebanese capital in almost two decades. The development, a major escalation of hostilities, could further intensify the raging multi-front conflict in the Middle East, at least temporarily.

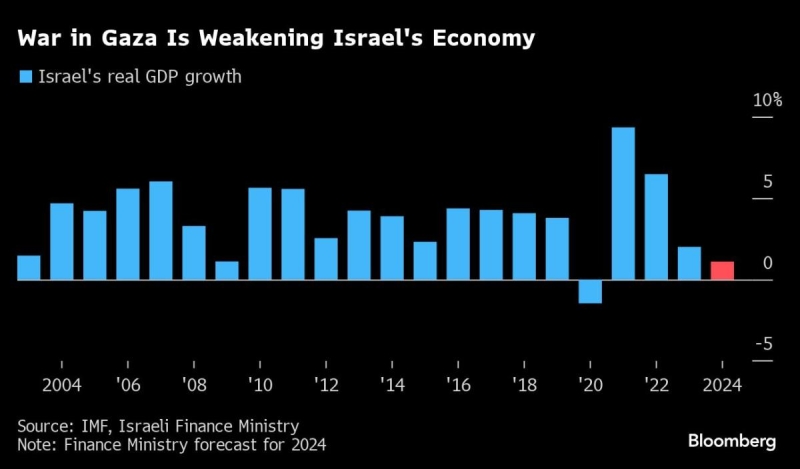

The conflicts have proved financially costly for Israel. Government spending and the budget deficit are soaring, while sectors such as tourism, agriculture and construction have slumped.

Israeli officials estimated the cost of the conflicts through the end of next year would amount to roughly $66 billion, or more than 12% of gross domestic product. That figure was based on the fighting with Hezbollah not escalating into an full-blown confrontation.

Israel’s 12-month trailing budget deficit stood at 8.3% of GDP in August. The country’s full-year fiscal gap is set to be the widest this century, excluding the Covid-19 pandemic.

This month, the finance ministry cut its 2024 economic growth projection to 1.1% from 1.9%. The estimate for next year was lowered to 4.4% from 4.6%.

“Decisive and quick steps” must be taken to approve a state budget for 2025, said Rothenberg.

“The state budget must encourage growth engines, investment in infrastructure, consideration of social needs and response to Israel’s security requirements,” he added.

The government’s borrowing — most of it in the domestic market — has soared to fund the war effort. The shekel has been resilient, thanks in large part to the central bank announcing a $30 billion package to support the currency soon after the war against Hamas erupted in October.

Still, Israeli bonds have taken a hit. Yields on 10-year shekel notes are up almost 100 basis points this year and their spreads over US Treasuries are at an 11-year high. Israel’s dollar bonds are among the worst-performing globally when compared to other sovereign issuers, according to Bloomberg indexes.

Moody’s lowered Israel’s rating to A2 from A1 in February, in what was the country’s first-ever downgrade. The conflict will “materially raise political risk for Israel as well as weaken its executive and legislative institutions and its fiscal strength, for the foreseeable future,” Moody’s said at the time.

Back then, Prime Minister Benjamin Netanyahu downplayed the impact of the move, which was followed by S&P Global Ratings downgrading Israel to A+ and Fitch Ratings lowering it to A.

Hezbollah and Hamas are both backed by Iran and designated as terrorist groups by the US. Netanyahu says the military’s bombardment of Hezbollah targets will continue until Israelis displaced from northern communities are able to return home.

Hezbollah says its attacks on Israel won’t stop until there’s a cease fire in Gaza.

(Updates to add outlook in second paragraph, government comment starting in sixth)

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.