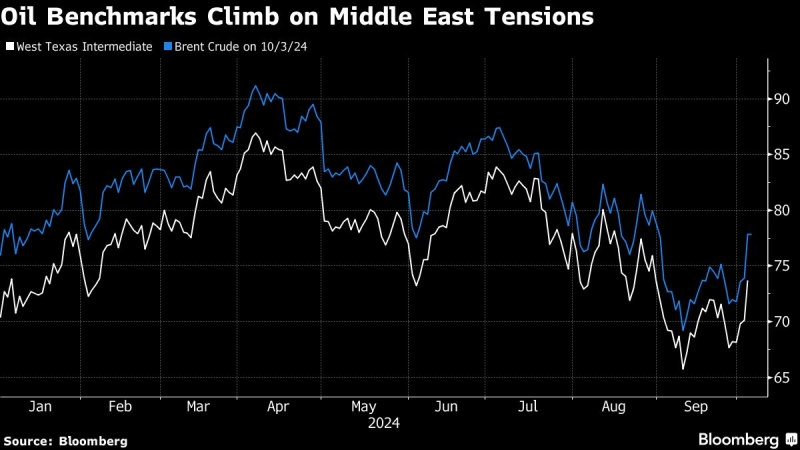

(Bloomberg) — Oil rose as tensions in the Middle East unnerved investors before US jobs data due later Friday that will help identify the path ahead for interest rates.

Most Read from Bloomberg

West Texas Intermediate crude extended gains early Friday after rising more than 5% Thursday to a one-month high, along with global benchmark Brent. The rise accelerated after puzzling comments from President Joe Biden, who told reporters the US was discussing whether to support potential Israeli strikes against Iranian oil facilities.

Investors are concerned that, should Israel strike critical Iranian assets, the Islamic Republic will lash out and escalate the conflict, dragging in more countries and potentially disrupting global energy shipments. Israel said it bombed more than a dozen Hezbollah targets in Beirut on Thursday.

Shares in Japan were little changed, while those in Australia fell alongside Hong Kong equity futures. Mainland China markets are shut for a holiday. Contracts for the S&P 500 and Nasdaq were steady early Friday after the two indexes closed slightly lower Thursday. Energy companies outperformed on the higher oil price.

An index of dollar strength was steady in early trading following a fourth straight day of gains on Thursday, tracking a rise in Treasury yields. The 10-year yield rose six basis points to 3.85%, its highest level since early September. Australian and New Zealand yields rose early Friday.

The yen strengthened in early trading, while the pound was stable after falling sharply against the dollar the prior day on signs the Bank of England may cut rates more aggressively.

Amid all the geopolitical uncertainty, investors are looking for further signals on the health of the US economy, with the monthly payrolls report due on Friday. The unemployment rate is forecast to hold steady at 4.2% in September while payrolls are expected to rise by 150,000.

“If the unemployment rate ticks up, I wouldn’t be surprised that markets would shift back toward expecting 50 basis points and then it is a question of how the Fed may react,” Kallum Pickering, chief economist at Peel Hunt, said on Bloomberg Television.

Other economic signs showed robustness in the US economy. The Institute for Supply Management’s index of services posted its best reading since February 2023, ahead of Wall Street estimates. Applications for US unemployment benefits rose slightly last week to a level that is consistent with a limited number of layoffs. Continuing claims, a proxy for the number of people receiving benefits, were little changed from the previous week.

The readouts “were both solid in September,” according to JPMorgan Chase & Co.’s Abiel Reinhart. Initial jobless claims “on balance continue to look quite low, which is a good sign for the job market,” he wrote in a research note.

In Asia, data set for release includes S&P Global PMI figures for Hong Kong, inflation in the Philippines and retail sales in Singapore.

Key events this week:

-

US nonfarm payrolls, Friday

Some of the main moves in markets:

Stocks

-

S&P 500 futures were little changed as of 8:53 a.m. Tokyo time

-

Hang Seng futures fell 0.3%

-

S&P/ASX 200 futures fell 0.5%

Currencies

-

The Bloomberg Dollar Spot Index was little changed

-

The euro was little changed at $1.1035

-

The Japanese yen was little changed at 146.80 per dollar

-

The offshore yuan was little changed at 7.0479 per dollar

Cryptocurrencies

-

Bitcoin was little changed at $60,726.96

-

Ether rose 0.3% to $2,348.69

Bonds

-

The yield on 10-year Treasuries advanced six basis points to 3.85%

-

Australia’s 10-year yield advanced six basis points to 4.07%

Commodities

-

West Texas Intermediate crude rose 0.3% to $73.90 a barrel

-

Spot gold was little changed

This story was produced with the assistance of Bloomberg Automation.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.