(Bloomberg) — Chile’s consumer prices rose less than forecast last month, providing the central bank with some good news as policymakers signal they will cut the interest rate again next week.

Most Read from Bloomberg

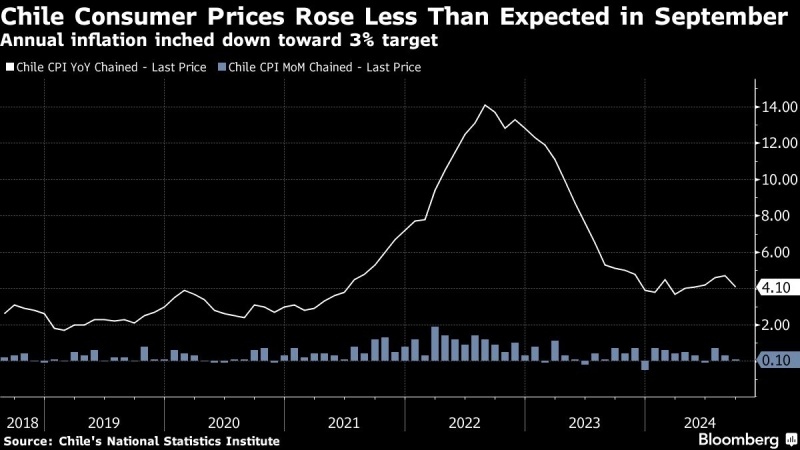

Prices rose 0.1% from August, matching the lowest estimate in a Bloomberg survey of analysts that had a 0.3% median forecast. Annual inflation ticked down to 4.1% in the chained series, while remaining above the 3% target, the National Statistics Institute reported on Tuesday.

Central bankers led by Rosanna Costa are riding out a series of electricity tariff hikes as they loosen monetary policy in one of Latin America’s richest nations. The next energy bill increase is scheduled for October, pressuring the local cost of living into early 2025. Still, consumer demand is uneven, while crucial sectors such as real estate remain weak, helping to cool inflation.

Food and non-alcoholic beverage costs fell by 0.5% during the month, while alcoholic beverages and tobacco declined by 0.4% and transportation dropped 0.3%, according to the statistics institute. Clothing jumped by 3.3% in the period.

The central bank says borrowing costs are likely to fall from 5.5% currently toward a neutral level given the lower consumer price risks, according to the minutes of the last policy decision published in September. That level is between 3.5% and 4.5%, according to policymaker estimates.

Finance Minister Mario Marcel has said less expensive gasoline and recent gains in the peso will blunt the inflationary hit from higher electricity tariffs. A stronger currency helps the price outlook by keeping a lid on import costs.

Furthermore, economic activity shrank 0.2% in August on declines in services and industry, surprising analysts who had forecast a third monthly gain.

Economists and traders see central bankers delivering quarter-point rate cuts on Oct. 17 and then again at the final policy meeting of the year in December.

The central bank expects annual inflation to end 2024 at 4.5% and then ease to 3.6% by December of next year before hitting the target in early 2026, according to estimates published last month.

–With assistance from Giovanna Serafim.

(Updates with inflation report details in fourth paragraph)

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.