Goldman Sachs (GS) third-quarter profits surged 45% from a year ago as a rise in dealmaking and stock trading lifted the Wall Street giant.

Net income was nearly $3 billion, up from roughly $2 billion in the third quarter of 2023. Investment banking fees were $1.8 billion, up 20% from the year-ago period, as companies issued more debt and equity.

Even its advisory fees were up slightly thanks to a revival in mergers and acquisitions.

Goldman’s stock rose more than 3% in pre-market trading Tuesday, and it has climbed 28% year to date to a record high, outperforming its other big-bank rivals.

The results offer the latest sign that a two-year-long dealmaking drought appears to be ending as the Federal Reserve starts to lower interest rates, a move that is expected to spur more deals in the year ahead.

Goldman's rivals are showing similar boosts to their Wall Street operations. Investment banking fees at Wells Fargo (WFC) were up 37% in the third quarter when compared to a year ago, while they rose 31% at JPMorgan (JPM). Bank of America (BAC) reported Tuesday that its investment banking fees were up 18%.

Some other parts of Goldman also fared well. Goldman’s trading revenue rose 2% year over year, driven primarily by equities traders, while asset and wealth management revenue increased 16%.

But Goldman did post a pretax hit to earnings of $415 million in its consumer business related partly to a credit card partnership with General Motors (GM) that Goldman is shedding. Barclays said Monday that it is buying that business.

Goldman is also trying to shed a credit-card partnership with Apple (APPL).

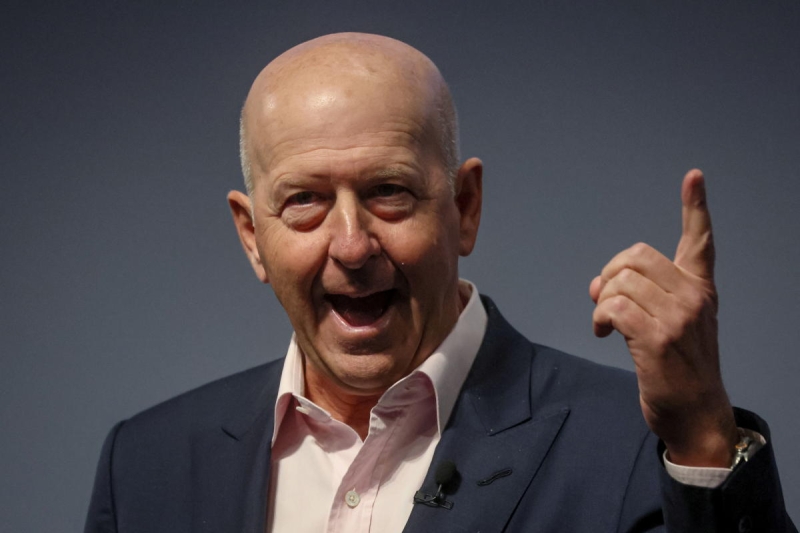

Goldman Sachs CEO David Solomon, in 2023. REUTERS/Brendan McDermid (REUTERS / Reuters)

The $415 million hit shows Goldman is still in the midst of a broader retrenchment out of consumer lending as it tries to re-focus on its core competencies of dealmaking, trading and asset management.

But it is in a much stronger position than it was a year ago, when CEO David Solomon was grappling with a slump in dealmaking, the costly exit from consumer lending, and a series of high-profile departures from the firm.

"Our performance demonstrates the strength of our world-class franchise in an improving operating environment," CEO David Solomon said in a statement.

David Hollerith is a senior reporter for Yahoo Finance covering banking, crypto, and other areas in finance.