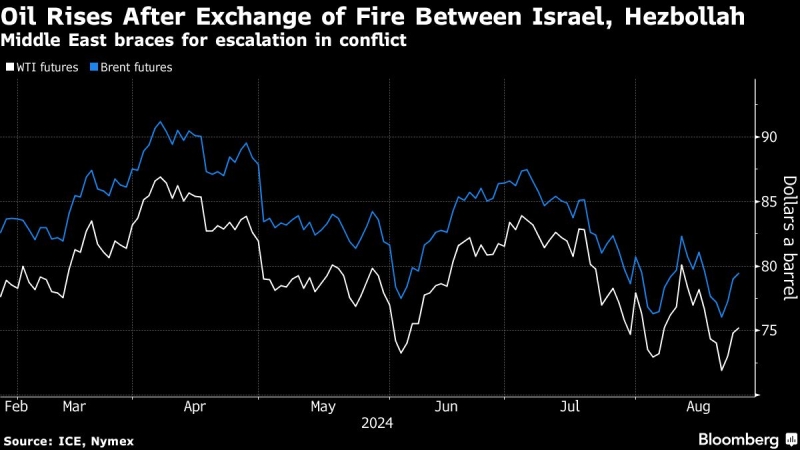

(Bloomberg) — Oil advanced as the Middle East braced for escalating conflict after an Israeli strike on Hezbollah targets in southern Lebanon.

Most Read from Bloomberg

Global benchmark Brent rose above $79 a barrel, while US marker West Texas Intermediate climbed to near $75. Israel on Sunday morning sent more than 100 warplanes to take out thousands of Hezbollah missile launchers, after which the militant group responded by firing more than 200 projectiles that did limited damage, according to Israeli officials.

Hezbollah, which is backed by Iran and designated a terrorist organization by the US, said it “concluded” its military operation for the day but that it will continue hostilities with Israel until the country agrees to a cease-fire in Gaza.

Oil is now marginally higher for the year, aided by geopolitical risks, and a likely US interest-rate cut next month. Federal Reserve Chair Jerome Powell gave his most decisive signal yet that his inflation-fighting mission has been accomplished at his speech in Jackson Hole, Wyoming, on Friday, saying that “the time has come for policy to adjust.”

In a sign of relative calm after the exchanges of fire, negotiations in Cairo aimed at establishing a pause in the fighting between Israel and the Palestinian militia Hamas commenced as planned on Sunday. Israel also relaxed safety restrictions on its population on Sunday night, after earlier imposing a state of emergency and shutting its main airport for several hours.

Meanwhile, Powell’s comments cemented expectations for a rate cut at the central bank’s next gathering in September. Crude traders largely expect lower interest rates to spur economic growth and increase demand.

Timespreads are also showing underlying strength. The gap between the two nearest contracts for Brent has widened in a bullish, backwardated structure — when the prompt contract trades at a premium to the following one. The spread is 92 cents a barrel in backwardation, up from 57 cents at the start of the month.

To get Bloomberg’s Energy Daily newsletter into your inbox, click here.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.