(Bloomberg) — Libya’s eastern government said it will shut down all oil production and exports, after a spat with its Tripoli-based rival escalated over control of the central bank.

Most Read from Bloomberg

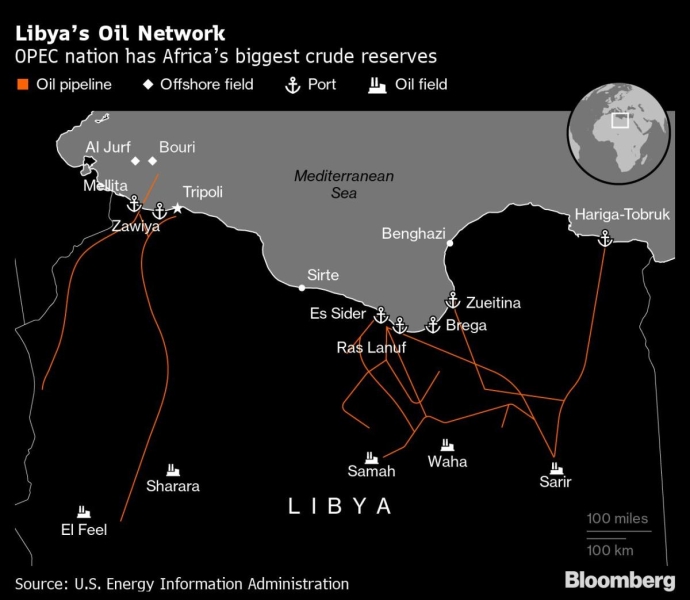

Brent crude jumped as much as 3% to above $81 a barrel, after the eastern authorities said Monday in a statement on Facebook that a “force majeure” applies to all fields, terminals and oil facilities. Waha Oil Co., which supplies Es Sider — the country’s largest export terminal — said it will start cutting shipments gradually.

Deep-seated political divisions in Libya’s east and west, despite a 2020 United Nations-backed cease-fire deal aimed at ending their fighting, have often resulted in battles and blockades that target the country’s most valuable resource. The nation sits atop Africa’s biggest known crude reserves, but production has suffered after a decade of political strife.

Libya has been wracked by unrest since the 2011 overthrow of longtime leader Moammar Al Qaddafi, with dueling governments embroiled in a tug-of-war that’s undercut efforts to revive the economy in the nation of 6.8 million people. Clashes between armed groups loyal to different factions or individuals are routine, at times leading to the shutdown of key oil fields.

A row over who leads the central bank, the manager of billions of dollars of energy revenue, has been brewing for over a week now, deepening political divisions and threatening a UN-brokered peace deal. The internationally acknowledged government in the country’s west has been seeking to replace the governor Sadiq Al-Kabir, who has refused to step down. A government delegation entered the regulator’s offices today to take over, according to local media.

“The dependence of Libya economy on oil revenues means that whoever controls the state institutions that oversee these funds effectively controls the country’s economy,” Citigroup Inc. analysts including Francesco Martoccia said in a note earlier on Monday. “This has turned into a conflict zone for the competing factions, with each side seeking to secure its own financial interests.”

A drop in exports may temporarily push Brent crude to the mid-$80s a barrel, according to Citi.

The country produced a total of about 1.15 million barrels a day of oil last month, according to data compiled by Bloomberg. Since then, the biggest oil field called Sharara, which was pumping nearly 270,000 barrels daily, has halted. The east is home to the Sirte basin where most of Libya’s oil reserves and four of the country’s oil export terminals are located.

The central bank saga itself comes after a series of oil-sector firings by Prime Minister Abdul Hamid Dbeibah, raising claims that he’s trying to exert full control over the country’s most valuable industry.

(Updates with Waha Oil Co. statement in second paragraph.)

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.