(Bloomberg) — Investors in the US Treasury market are divided on whether the Federal Reserve will opt for a supersized interest-rate cut later this month — though they still expect the central bank to imminently kick off its easing cycle.

Most Read from Bloomberg

With a US labor report for August and key Fed speakers failing to send a clear message to markets on Friday, traders are pricing in a less than 20% chance that officials lower rates by half a percentage point in September. The yield on two-year Treasuries — which are more sensitive than longer maturities to changes in the Fed’s policy outlook — slid by as much as 11 basis points to 3.63%.

“It is difficult to handicap exactly how much the Fed will cut at each meeting,” said Gene Tannuzzo, global head of fixed income at Columbia Threadneedle. “But the direction of travel is clear.”

Traders went into Friday eager for clear guidance from the August employment report and Fed speakers on the scope ahead for Fed rate cuts. According to the data, job creation slowed and the unemployment rate fell.

Treasuries flip-flopped in the wake of the report and amid comments from New York Fed President John Williams, Fed Governor Christopher Waller and Chicago Fed President Austan Goolsbee.

All three said it’s time to begin cutting rates, with Waller taking it a step further by noting that he’s “open-minded” about the potential for a bigger rate cut and would advocate for one if appropriate.

What Bloomberg Strategists Say…

“[Waller] alludes to the need to see more data to determine the ultimate scope and pace of easing, so from his perspective the jury is evidently still out on how aggressive to be. Combine these remarks with those from John Williams earlier, and there still isn’t compelling evidence that the FOMC is set to cut 50 bps.”

— Cameron Crise, strategits. Read more on MLIV.

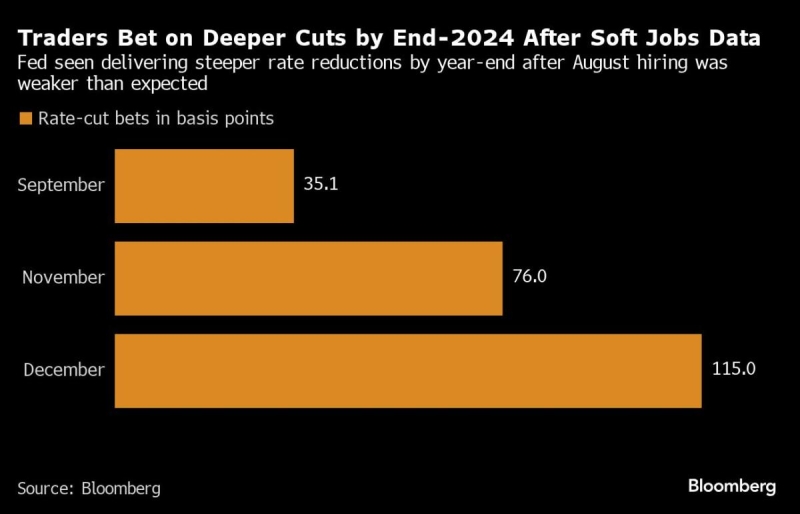

When the dust settled, swaps traders priced in about 30 basis points of rate reduction by the Fed this month. For all of 2024, the contracts now imply about 112 basis points of reductions.

More broadly, a Bloomberg gauge of Treasuries is set to cap a week of gains, extending a four-month gaining streak fueled by rising confidence in the case for lower US borrowing costs.

And a key segment of the Treasury yield curve, which is often seen as a harbinger for recession, is on track to close the session positive for the first time in about two years.

“The market is ‘only’ pricing the Fed to reach a longer-run ‘neutral’ rate of around 3%,” said Tannuzzo. “The market is still not pricing them to reach an accommodative stance. Whether or not an accommodative stance is warranted will depend on the labor market and how quickly further deterioration is realized.”

On Friday, Bank of America economist Aditya Bhave boosted the firm’s forecast for Fed easing, forecasting a 25-basis-point cut at each of the next five meetings.

The “tricky” jobs report left “investors guessing if the Fed will cut by 25 basis points or 50 basis points at the September FOMC meeting,” Subadra Rajappa, head of US rates strategy at Societe Generale, said.

Next week, reports on both consumer and producer prices in August are slated. All of which could set the market up for continued volatility, with Fed officials going into their pre-meeting blackout period over the weekend.

“I’ve been in the camp they shouldn’t go 50, they should go 25,” said Tony Farren, managing director in rates sales and trading at Mischler Financial GroupNow. “I see an over-50% chance they go 50 basis points” as long as the inflation data comes in “tame.”

–With assistance from Michael Mackenzie and Edward Bolingbroke.

(Updates with more details and comments throughout.)

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.