(Bloomberg) — Gold may face a minor, near-term setback if the Federal Reserve opts for just a 25-basis-point cut this week, but the metal will subsequently rally to a record aided by rising flows into bullion-backed exchange-traded funds, according to Goldman Sachs Group Inc.

Most Read from Bloomberg

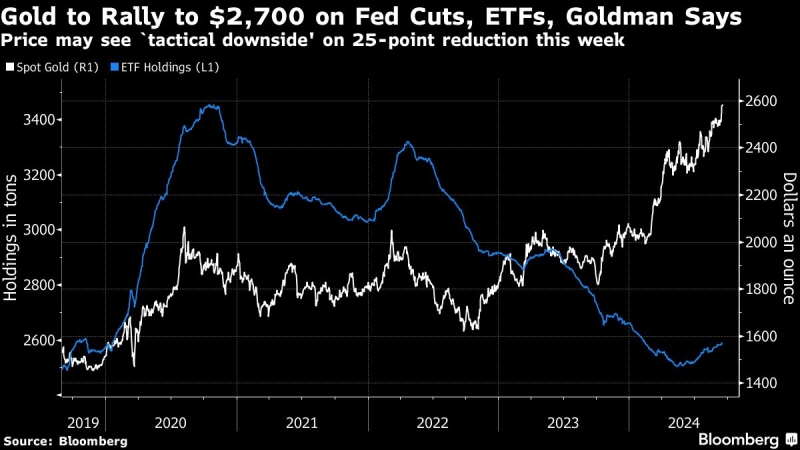

“Fed rate cuts are poised to bring Western capital back into gold ETFs, a component largely absent of the sharp gold rally observed in the last two years,” analysts Lina Thomas and Daan Struyven said in a note, reiterating the bank’s forecast for surge to $2,700 an ounce by early next year.

The precious metal has been one of the strongest performing major commodities this year, surging by about a quarter and hitting successive records as central banks boost purchases and traders look ahead of the Fed’s pivot to monetary easing. Investors remain divided about whether the US central bank will kick off its easing cycle this week with a half-point reduction or — as Goldman Sachs expects — a more modest 25-basis-point cut.

“While we see some tactical downside to gold prices under our economists’ base case of a 25-basis-point Fed cut on Wednesday, we expect a gradual boost to ETF holdings — and thus gold prices — from the Fed’s easing cycle,” the analysts said. “Since ETF holdings only increase gradually as the Fed cuts, this upside is not yet fully priced in,” they added.

Global holdings in bullion-backed ETFs have rebounded in recent months after sinking in mid-May to the lowest since 2019, according to a Bloomberg tally. Despite gold’s sustained surge, they remain lower year-to-date, and about 25% below the peak set during the pandemic in 2020.

As ETFs are backed by bullion, inflows “reduce the physical supply of gold available to the market,” the analysts said.

Spot gold was last little-changed near $2,585 an ounce. Silver — which can track moves in the more expensive precious metal — gained toward $31 an ounce, rising for a seventh day and on course for the longest run of gains since 2019.

(Updates gold price in final paragraph, adds silver.)

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.