(Bloomberg) — Two oil refiners in China run by chemical conglomerate Sinochem Group Co. were declared bankrupt, highlighting the headwinds older units face as margins plummet.

Most Read from Bloomberg

The creditors of Zhenghe Group Co. and Shandong Huaxing Petrochemical Group Co., both based in the eastern province of Shandong, failed to agree on restructuring plans for the indebted plants and the businesses were declared bankrupt, according to separate statements from a local court.

Sinochem didn’t immediately reply to an email seeking comment sent to its Beijing headquarters during a holiday in China.

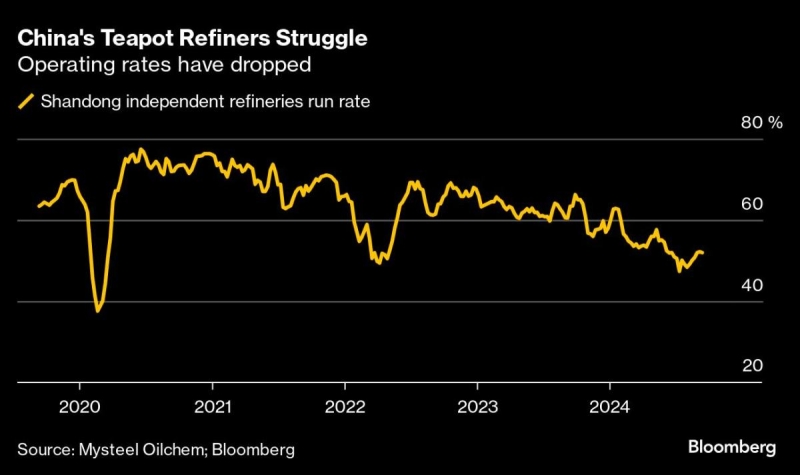

China’s so-called teapot refineries — small and simple processing facilities that are mostly privately owned — are facing lackluster demand for fuels as the nation’s economic recovery fails to gather pace and electric vehicle usage grows. That has led to plummeting operating rates at the teapots clustered in Shandong.

The two plants, which applied for restructuring last year, used to be part of China National Chemical Corp., or ChemChina, and were taken over by Sinochem when the two groups merged. Argus reported their bankruptcies earlier.

Another Sinochem teapot, Shandong Changyi Petrochemical Co., was scheduled to host a meeting with creditors in late September, according to a separate statement. The three plants, formed to process crude from a local field in the last century, have a combined nameplate processing capacity of more than 300,000 barrels a day, although most of their units have been idled for months.

–With assistance from Serene Cheong.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.