(Bloomberg) — The Federal Reserve kicked off its campaign to lower interest rates with a larger-than-typical half percentage-point cut, while the Bank of England decided against a second consecutive reduction.

Most Read from Bloomberg

The Fed’s rate cut, which was larger than forecasters had generally anticipated, is Chair Jerome Powell’s attempt at ensuring a soft landing for the economy. In the UK, central bankers warned investors they won’t rush to ease monetary policy as they await further signs that inflationary pressures have subsided. Neither decision was unanimous.

Meantime, Bank of Japan Governor Kazuo Ueda pushed the likelihood of an October rate hike further to the sidelines Friday with a cautious message that pointed to ongoing concern over the market meltdown that followed July’s rate increase.

Here are some of the charts that appeared on Bloomberg this week on the latest developments in the global economy, markets and geopolitics:

US

Updated projections released alongside the Fed’s rate decision also showed that while the median official supported another 50 basis points in cuts over their final two meetings this year, policymakers are still split over how much more to ease before inflation has definitively returned to the central bank’s 2% target: Seven of 19 envisioned only 25 basis points of additional cuts in 2024 and two opposed any further moves this year.

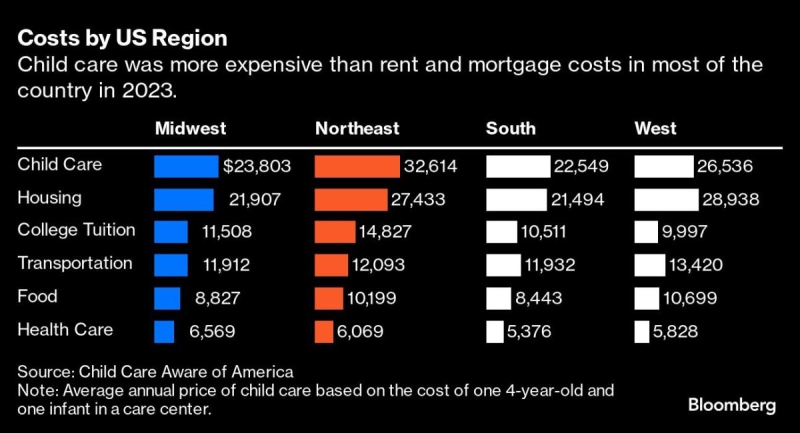

In the US, an average family of four will spend more annually on child care than they do on housing. Both presidential candidates have put forward specific policy proposals to address housing affordability. But neither Kamala Harris nor Donald Trump have detailed how they would reduce costs for parents who are now in many cases spending $33,000 a year for two kids in day care.

Donald Trump has promised to use sweeping new tariffs to fund everything from tax cuts to child care. But economists say the new import charges are unlikely to create anything close to the revenue boom he would need.

Europe

Policymakers from London to Frankfurt are signaling limited appetite to follow the US with steep cuts in borrowing costs, opening up a new transatlantic divide over the speed of global loosening.

Ireland could need to complete around 52,000 new homes each year until 2050 to house the country’s growing population, according to the central bank, a figure that far exceeds current government targets of 33,000 annually. Obtaining debt and equity funding may be made more challenging by a complex planning process and low productivity in the construction sector, it said.

Asia

The BOJ was seen wanting to monitor the impact of July’s move and to avoid spooking markets again with a surprise. A hold also keeps the bank out of the spotlight as Japan’s Liberal Democratic Party chooses a new leader on Sept. 27 to take on the role of prime minister. The central bank may also want to check on how markets respond to the result of the US election.

Officials in Jakarta raced ahead with a quarter-point cut on Wednesday, and lower rates in the US will free up space for rate setters from Seoul to Mumbai to move too. While regional central banks were forced to maintain a tight stance for months for fear of putting pressure on their currencies, the focus now shifts to how much and how quickly they’ll cut, or in some cases whether they ease policy at all.

China’s broad budget expenditure shrank at a faster clip amid an unprecedented drop in income earned by local governments from land sales, an alarming sign for an economy desperately in need of fiscal support.

Millions of ambitious Chinese professionals have had their lives upended by President Xi Jinping’s decision to reshape the world’s second-largest economy. Industries such as finance, consumer tech and property — key drivers of China’s growth for much of this century — are now out of favor. Instead, the most powerful Communist Party leader since Mao Zedong is funneling resources toward endeavors such as electric vehicles and chip production. “High quality” growth is the new mantra, not “high speed.”

Emerging Markets

Argentina’s economy sunk deeper into recession in the second quarter as ripple effects from President Javier Milei’s currency devaluation and austerity exacerbated a downturn. Milei hasn’t paid a political cost yet after he bluntly warned citizens during his inauguration address that his so-called “shock therapy” would indeed be painful.

Floods in Africa that are displacing millions of people from Guinea on the west coast to the Central African Republic more than 2,000 miles to the east are prompting warnings of dam bursts and disease. In Chad, rising waters in the Chari and Logone dams could cause “catastrophic floods,” a United Nations agency warned, and Cameroon’s government boosted its financial response more than fivefold.

World

Warehouses across China are bulging with grain as a deepening economic crisis takes hold, leaving the world’s farmers to grapple with the prospect of a long-lasting slowdown gripping one of their largest customers. The strain across global markets is already showing.

A cup of coffee is set to get even pricier as persistent supply disruptions push costs for premium arabica beans to the highest in 13 years. The most-active contract eased later in the week as forecasts signaled rain in parts of top producer Brazil, which has faced persistently hot and dry weather.

Outside of the major central banks, Indonesia unexpectedly reduced rates for the first time in three years, while South Africa and Eswatini also cut. Taiwan, Norway, Ukraine, Turkey, Angola, Chinese banks and Paraguay held steady. Brazil’s central bank raised its interest rate by a quarter-point and said more hikes are coming on resilient growth and inflation expectations.

–With assistance from Catherine Bosley, Kelsey Butler, Jackie Cai, Ougna Camara, Lulu Yilun Chen, Enda Curran, Katia Dmitrieva, Shawn Donnan, Olivia Fletcher, Toru Fujioka, Patrick Gillespie, Mumbi Gitau, Charlotte Hughes-Morgan, Yinka Ibukun, Sumio Ito, Zheng Li, John Liu, Pius Lukong, Jonnelle Marte, Tom Rees, Zoe Schneeweiss, Qingqi She, Amanda Wang and Fran Wang.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.