(Bloomberg) — Bond investors’ big bet on US Treasuries is paying off after Federal Reserve Chair Jerome Powell cemented expectations for an interest-rate cut next month.

Most Read from Bloomberg

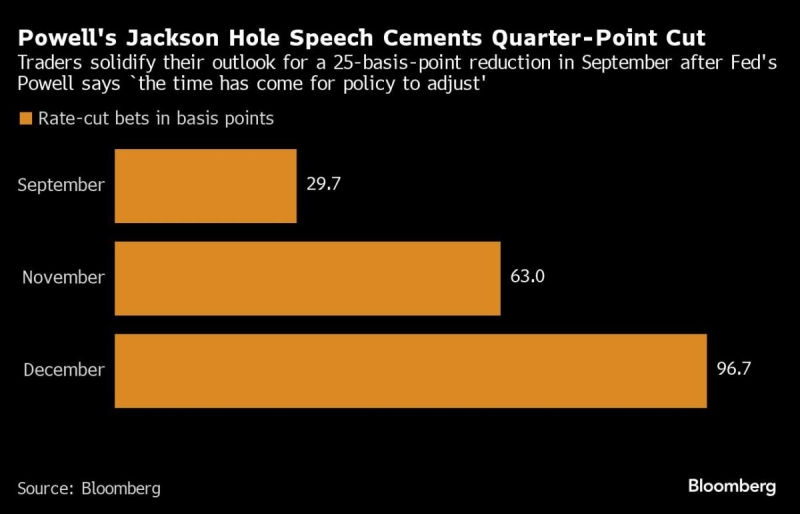

Treasuries rallied on Friday, pushing down yields on policy-sensitive two-year notes by as much as 9 basis points to 3.91%, after Powell said during a speech in Jackson Hole, Wyoming, that “the time has come for policy to adjust.” Those comments vindicated many in the bond market who have been adding to wagers the central bank will cut soon — and perhaps big.

Traders are now pricing in 101 basis points of easing this year, which implies a reduction at every remaining policy meeting through December, including one jumbo 50-basis-point cut.

“This is a relief rally,” said Tracy Chen, portfolio manager at Brandywine Global Investment Management. “It is a confirmation to the market that Powell is on his track to cut rates, even though he is still data dependent.”

Treasuries have been rallying since May as cooling inflation and a softening labor market prompted investors to bet that the Fed will start an easing cycle in September. A surprising rise in the unemployment rate even fueled concern the Fed has been too slow in lowering borrowing costs.

Traders are pricing in a total of 210 basis points worth of easing by September 2025. Last week, the number of leveraged positions in Treasury futures risen to an all-time high as traders braced for Powell to confirm that the easing cycle is just around the corner.

At the Fed’s annual symposium, Powell was far from disappointing bond bulls. While he said the “timing and pace of rate cuts” will depend on incoming data, “the direction of travel is clear.” He also said the Fed doesn’t “welcome further cooling in labor market conditions.”

Powell’s emphasis on the labor market is “really a clean turning point toward normalizing policy, which is more important than the 50 versus 25 basis point debate in September, in my mind,” said Ed Al-Hussainy, a rates strategist at Columbia Threadneedle Investments.

What Bloomberg strategists say…

“Jerome Powell ultimately told us what we already knew, albeit perhaps a little more forcefully than some of his colleagues. It all throws the focus squarely upon the next payroll figure in a couple of weeks, and beyond that, of course, next month’s FOMC announcement.”

— Cameron Crise, macro strategist. Read more on MLIV

Friday’s outperformance of short-term notes left the yield curve steeper, which is a typical reaction when the Fed starts to lower borrowing costs. At 3.82%, the 10-year yields are 12 basis points below the two-year rates, narrowing from about 50 basis points in late June.

With Powell all but locking in trader expectations of a September rate cut, the debate heats up about how fast the Fed will bring down borrowing costs. Fed officials this week have been saying the pace of subsequent cutting should be gradual and methodical.

Trading flows in interest-rate futures in the aftermath of Powell’s speech were mixed, with some wagers looking to benefit from a potential half-point rate cut at next month’s policy meeting while others look to fade the rally in the shorter-term rates.

To Jamie Patton, co-head of global rates at TCW Group, while Powell fell short of committing to any specific scale of cuts he did “leave the door open for a 50 basis point cut in September.”

The pace of the rate cut “will be answered by the data between now and then,” Patton said.

For the bond market, focus shifts to economic data for more evidence in favor of lower rates. Bullish investors had been burned earlier in the year when evidence of sticky inflation and strong job growth caused a pullback in expectations for rate cuts.

All eyes are now on the August payroll report due on Sept. 6, less than two weeks before the next policy meeting. Overnight index swaps contracts showed that traders are betting on a more than 20% chance for a jumbo 50 basis points of easing at the Sept. 18 meeting.

Gregory Faranello, head of US rates trading and strategy for AmeriVet Securities, said he’s betting on lower bond yields for some time and was encouraged by Powell’s “clear initiative toward protecting further downside” in the labor market.

“The pathway is intact,” he said.

(Updates with comments and more details throughout.)

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.