(Bloomberg) — Top-performing emerging-market bond managers are recalibrating positions as the most anticipated US interest rate cut in decades brings fresh impetus to an asset class buffeted by nearly $15 billion in outflows this year.

Most Read from Bloomberg

Investors from Pacific Investment Management Co. to Neuberger Berman and Grantham Mayo Van Otterloo & Co. are eyeing local-currency debt and select reform stories from countries including Ecuador and Argentina, which they say stand to benefit most from the boon the Fed cuts should provide to risk assets.

“You have to sort of pick and choose. If you just own the local bonds currency unhedged, you are wearing the full volatility of this index,” said Pramol Dhawan, the head of emerging-market debt at Pimco. He’s neutral to underweight investment grade, overweight “some of the high yielders” and long local-currency assets. “That’s a portfolio construct that will work.”

Emerging markets have been mired by volatility as global economic uncertainty and regional conflicts roil buoyant forecasts. A gauge of EM equities has gained about 14%, lagging a 26% rally for the S&P 500 Index. Most recently, investors have been left scrambling following the plunge in Mexico’s peso and wild swings in Brazil’s real amid a mix of local woes and the unwinding of global carry trade positions.

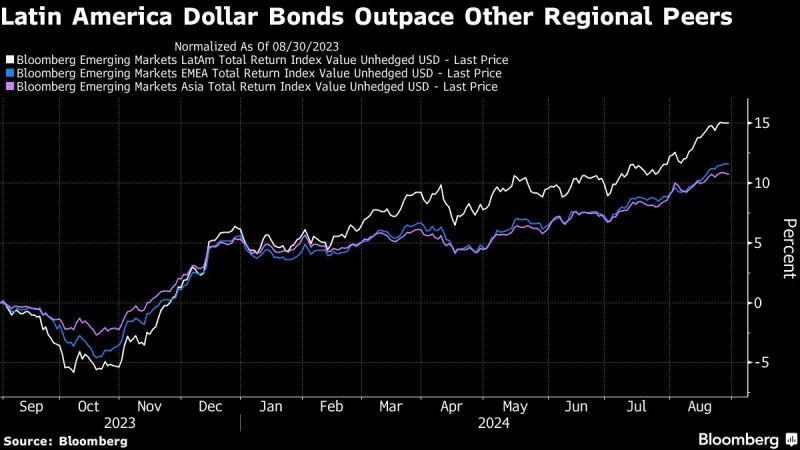

Even so, funds from GMO, Neuberger and Pimco have beaten over 90% of peers over the past year, returning more than 16% compared with an average of over 12% for 71 funds tracked by Bloomberg holding EM debt with more than $500 million in assets. They’ve done so in part by surfing substantial gains from high-yielding Latin American sovereign notes this year, a rally that’s now set to slow as prices become more fairly valued.

The expectation is that with lower US rates, more money will flow into emerging markets, which offer higher returns to investors. Developing nation bonds have seen a third year of outflows due to tight global financing conditions and geopolitical conflicts. Pimco’s Dhawan said the Fed’s cuts will trigger a domino effect, prompting EM central banks to follow suit and potentially unleashing a flood of capital into local markets.

The shift in markets has already begun to appear as the Fed clearly signaled a September cut. The past month was the best for EM domestic bonds this year, with more than 2.3% returns, according to data compiled on a Bloomberg index. Local-currency debt in developing nations has returned about half of what dollar bonds have in the past year.

Local markets have been “quite a strong performing trade strategy even against the backdrop of an appreciating dollar,” said Dhawan, who favors local bonds and currencies in Turkey and South Africa, as well as receiving long-term rates in Latin America. “If you’re well diversified within EMFX, it’s been quite a profitable trade.”

Tina Vandersteel, who manages $6.1 billion in EM debt at GMO, echoes that view, favoring local assets in the Dominican Republic, Uruguay, Egypt and Nigeria.

“Local markets still have a big relative valuation tailwind embedded in them,” she said.

Still, investors will remain cautious on exposure to currencies such as Brazil’s real and Mexico’s peso, which have underperformed. Samy Muaddi, head of emerging markets fixed income at T. Rowe Price, said he prefers to bet on local interest rate moves, while being hedged on currencies.

Reform Stories

The top contributors to EM bond returns in the last year have been high-yield credits, which have surged over 18%, compared with about 9% for investment-grade debt, according to data compiled on Bloomberg indexes.

Notes from some of the best performers — Ecuador and Argentina, boosted by economic reforms — haven’t lost favor. For Gorky Urquieta, who oversees about $25 billion in emerging-market debt at Neuberger Berman, both still offer attractive yields despite the lingering political risk.

“As long as things are going in the right direction in terms of reforms by the government,” he said. “There’s still a lot of scope for returns and for spreads to compress.”

While investors may hold on to these bonds to harvest the high coupons, it’s time to look beyond high-yield sovereign debt as they’ve become more fairly valued from being “extremely cheap,” said T. Rowe’s Muaddi.

EM bond funds have struggled to attract inflows amid the prospect of higher-for-longer rates in the US, notching just nine positive weeks this year, according to data from JPMorgan. While the $15 billion in outflows marks an improvement from a $31 billion exit in 2023 and a $90 billion exodus in 2022, it underscores the challenge facing managers.

“EM is just one of those places which I think is rich with opportunities, but you don’t want to be last to the game,” Dhawan said. “You have to move a little bit ahead of the Fed on this and start reallocating your portfolios.”

What to Watch

-

In Brazil, the market is watching for a second-quarter GDP print that should confirm robust expansion of the economy. Argentina central bank’s monthly survey of market expectations is due Thursday

-

Colombia inflation is likely to continue decelerating year over year, while Peru’s inflation rate is expected to fall to 2% in August

-

Countries including Indonesia, the Philippines, Thailand, Colombia and Peru report CPI data

-

Nigeria’s GDP likely accelerated year on year in 2Q24, aided by a pick up in activity in the oil sector

-

In Asia, traders are eyeing China’s PMI data

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.