(Bloomberg) — Brazil’s central bank raised its 2024 growth forecast and now sees the economy expanding in line with the most optimistic estimates, corroborating its decision to start an open-ended cycle of interest rate hikes.

Most Read from Bloomberg

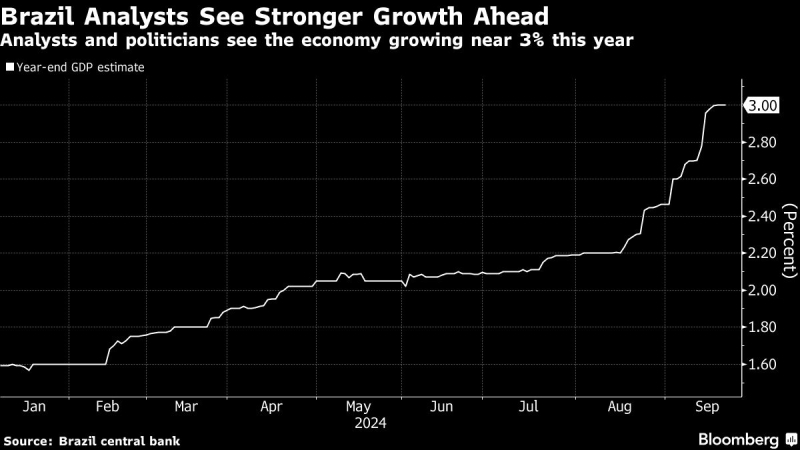

The bank expects gross domestic product to expand 3.2% this year, up from June’s estimate of 2.3%, according to its quarterly inflation report published Thursday. Analysts see the economy rising 3% in 2024 while the government forecasts 3.2% growth. For 2025, the bank sees GDP expansion at 2%.

Central bankers see the local economy cooling from the second half of the year through 2025. Government spending should slow down while interest rates rise in an outlook of modest global growth, policymakers wrote in the report.

“We estimate fiscal results will improve through time,” they said.

Latin America’s largest economy has consistently surprised analysts and government officials this year with stronger-than-expected activity. Low unemployment and higher public spending are boosting household consumption and investment is also picking up. Yet, heated demand is tilting inflation risks to the upside, forcing the central bank to lift borrowing costs.

Policymakers led by Roberto Campos Neto raised the benchmark Selic by a quarter-point to 10.75% last week in their first interest rate hike since 2022. Rising wages in the absence of productivity gains could increase price pressures, just as evidence mounts that a recent disinflation process has been “interrupted,” central bankers wrote in the minutes to that decision.

Inflation Improvement

Annual inflation slowed more than expected in early September, to 4.12%, the national statistics agency reported. That figure is still above the 3% target.

That inflation report showed an “improvement” with “slightly better” core measures that exclude energy and food, Campos Neto told journalists later Thursday in Sao Paulo. Yet, the board isn’t focused on short-term information and instead remains data-dependent in an “open-ended” cycle, he said.

“Giving rate guidance at this time won’t have a positive result,” Campos Neto said. He noted there was no debate over the possibility of a larger, half-point hike at last week’s decision.

Traders, however, see the board accelerating to half-point increases as soon as November, while analysts expect borrowing costs to hit 11.75% in the first months of 2025. Earlier this week, Campos Neto said a recent rise in Brazil’s risk premium on the fiscal front seems “exaggerated.”

“Our job is to explain what we are seeing, in the understanding that we can have differences with market prices,” Campos Neto said on Thursday.

Tolerance Range

In the next few months, central bankers see consumer price rises near the 4.5% ceiling of their tolerance range, they wrote in Thursday’s report. Energy costs are seen rising during the coming summer in the Southern Hemisphere.

Higher inflation forecasts, a stronger economy and a rise in analysts’ estimates of neutral rates — which neither restrict nor stimulate activity — are some of the reasons why investors are pricing in borrowing cost hikes, policymakers wrote. The bank’s own communication also played a part, they wrote.

Analysts and some former central bank board members say the current hiking cycle could be compensating for past rate decisions. “At some point, we can correct course on what we did in the past, but we don’t consider that a mistake,” Campos Neto told reporters.

President Luiz Inacio Lula da Silva is also boosting government spending to jolt activity and improve living standards, a move that’s increasing investor concerns over debt levels and consumer price growth. Most analysts see annual inflation at least half-point above the bank’s 3% goal through 2027.

–With assistance from Giovanna Serafim.

(Updates with comments from central bank press conference starting in 8th paragraph)

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.