(Bloomberg) — Mexico’s central bank should maintain a restrictive monetary policy stance so long as services prices remain elevated, according to bank Deputy Governor Jonathan Heath.

Most Read from Bloomberg

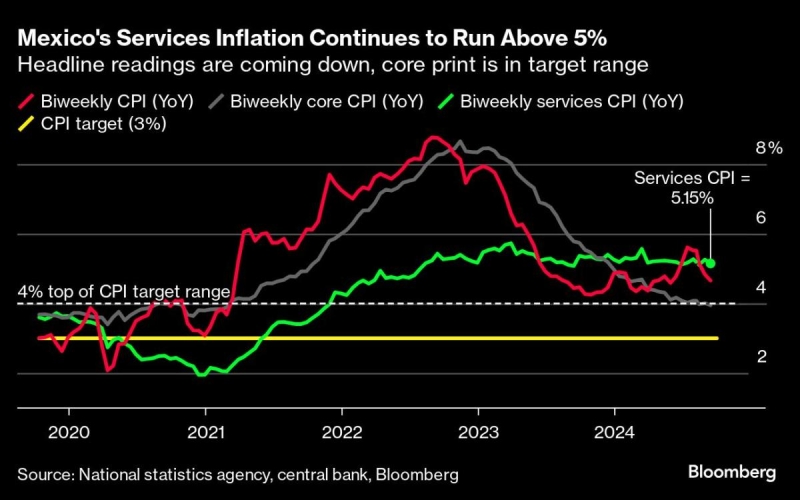

Annual inflation slowed to 4.66% in the first two weeks of September, almost a full percentage point lower than the mid-July figure. The core component, which excludes volatile items, has also decelerated.

But for Heath, the key to bringing core inflation back to the 3% target will require taming Mexico’s sticky services inflation.

“The only way we can get core inflation to continue its downward trend to 3% next year, as is our projection, is to break the persistence of services prices,” Heath said in a podcast organized by Grupo Financiero Banorte SAB released Wednesday. Services readings have been above 5% for more than two years.

Last Thursday, Banxico, as the central bank is known, cut its key interest rate by a quarter-point to 10.5% as inflation readings are easing faster than expected and the economy heads for a third year of slower growth.

Banxico’s Governor Victoria Rodriguez Ceja said the bank could mull changes to the magnitude of its interest rate cuts in coming meetings, opening the door to faster easing.

Heath, the only member of the central bank who voted to keep the benchmark interest rate unchanged last month, said that in the medium and long term, Banxico can’t go against the US Federal Reserve’s decisions.

“If they are continually lowering the rate, then somehow or another, and not with a perfect correlation by any means, we will also have to basically do the same.”

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.