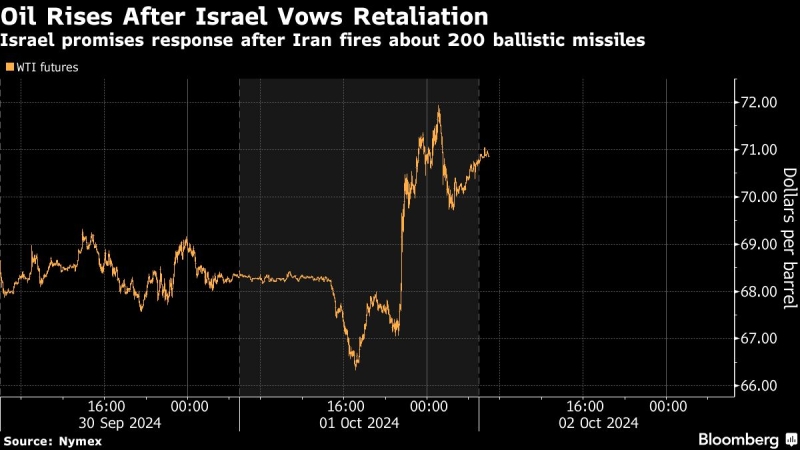

(Bloomberg) — Oil surged for a second day after Iran fired about 200 ballistic missiles at Israel, drawing a vow of retaliation from Prime Minister Benjamin Netanyahu and raising the risks to crude supplies.

Most Read from Bloomberg

West Texas Intermediate briefly topped $71 a barrel, after closing 2.4% higher on Tuesday following the Iranian assault, which was preceded by a warning from the US that an attack was imminent. Global benchmark Brent closed just below $74 a barrel.

Oil’s advance reflects investors pricing in a renewed risk premium for the world’s most important commodity, given the Middle East accounts for about a third of global supplies. Haven assets, including bonds, gold and the US dollar, also climbed on the latest escalation of the conflict.

While Israel and Iran have been facing off since the outbreak of the war in Gaza against Tehran-backed Hamas almost a year ago, previous spikes have tended to fade in the absence of actual interruptions to oil output.

“Any sustained rally in oil prices will be determined by whether Israel responds to this latest move” with a direct attack against Iran’s military, infrastructure or oil industry, ANZ Group Holdings said in a note.

Tensions in the Middle East have increased markedly after the killing of Hezbollah’s chief, Hassan Nasrallah, last week. Israel bombed the center of Beirut on Monday and its troops have begun what it called “targeted ground raids” in Lebanon. Hezbollah is also backed by Tehran.

After Tuesday’s missile salvo, Iran’s Foreign Minister Abbas Araghchi said his country’s action was concluded unless Israel “decides to invite further retaliation,” according to a post on X. In Israel, Netanyahu said Iran had made a big mistake, “and it will pay for it.”

OPEC+, meanwhile, is scheduled later Wednesday to hold an online meeting of a technical panel — the Joint Ministerial Monitoring Committee — to review global oil markets. The group is preparing to revive some of its idled production from December, after initially delaying that plan.

In the US, the American Petroleum Institute reported that nationwide crude inventories declined by 1.5 million barrels last week. That would be the third straight weekly drop if confirmed by official figures later Wednesday.

To get Bloomberg’s Energy Daily newsletter into your inbox, click here.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.