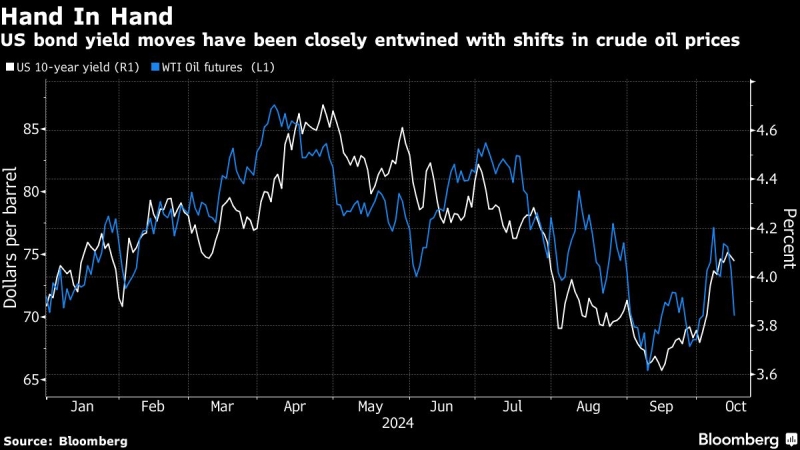

(Bloomberg) — Treasuries rallied the most in two weeks as tumbling oil prices eased concerns about an uptick in inflation.

Most Read from Bloomberg

Yields on US 10-year debt retreated from a two-and-a-half month high, falling as much as four basis points to 4.06%. Meanwhile, rates on German and UK peers dropped as much as six basis points.

Oil plunged more than 5% to dip below $70 per barrel on Tuesday following a report that Israel may avoid targeting Iran’s crude infrastructure as part of retaliation for a barrage of missiles launched at it earlier this month.

Investors have been growing increasingly concerned about a reacceleration of price pressures amid escalation in the Middle East — and the prospect for inflationary policies from whoever becomes the next US president.

“It looks like dealers simply have their machines tied to oil futures these days,” said Christoph Rieger, head of rates and credit research at Commerzbank AG. “Whether it makes sense to adjust your long-term inflation view on the back of this is a different question.”

Crude prices have been on a rollercoaster in recent weeks as traders track the conflict in the Middle East — home to about a third of global supply.

But concerns about inflation in the US have also risen after a jobs report earlier this month showed robust wage growth, and a hotter-than-forecast read of consumer prices.

Over the next four years, inflation is expected to rise above the Fed’s long-run estimates whether Donald Trump or Kamala Harris win the presidency, according to a survey of 29 economists conducted Oct. 7 to 10.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.