(Bloomberg) — Stocks in Asia and US futures declined along with bonds, as traders consider cooling expectations of Federal Reserve rate cuts for the rest of the year.

Most Read from Bloomberg

The MSCI AC Asia Pacific Index fell as much as 1.1%, as benchmarks in Japan, Australia and South Korea dipped. That’s after equities in the US dropped from nearly overbought levels, following a relentless advance to all-time highs. European contracts bucked the trend and rose.

Treasuries’ 10-year yields ticked up to 4.22% in Asian trading on Tuesday, after Federal Reserve Bank of Kansas City President Jeffrey Schmid said he favors a slower pace of interest-rate reductions given uncertainty about how low the US central bank should ultimately cut rates. Bonds from Australian and New Zealand fell.

The risk of a slower rate-cut pace “would be dollar-positive and also normally a headwind for Asia equities,” said Kieran Calder, head of equity research at Union Bancaire Privee in Singapore.

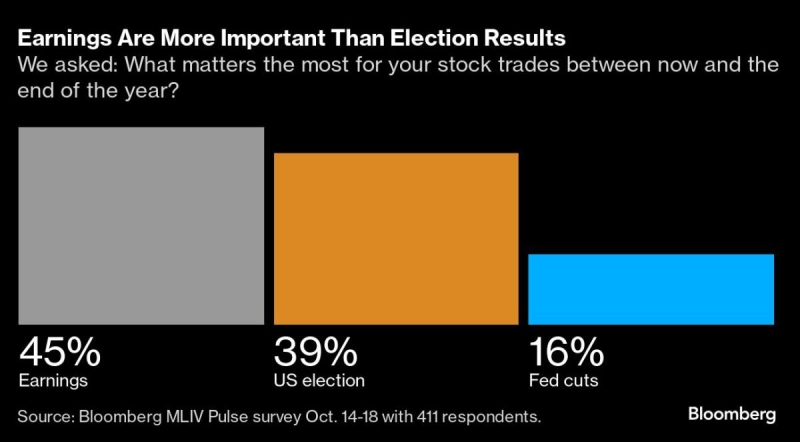

Several factors, including concerns over supply and better US economic data, are driving the bond selloff, Chris Weston, head of research at Pepperstone Group Ltd., wrote in a note. US election bets are also weighing on the market, with traders “front-running the risk of a ‘Red Sweep,’” he said, referring to the possibility of Republicans taking the White House and Congress.

A presidential win for Donald Trump will stoke concerns that his support for looser fiscal policy and steep tariffs will deepen the federal deficit and fuel inflation, undermining Treasuries.

The chances that Federal Reserve officials will leave interest rates unchanged in November are mounting as the US economy powers ahead, according to Torsten Slok, chief economist at Apollo Global Management.

Asia’s IPO markets are set for their busiest week of listings in more than two years, offering a crucial test of demand as companies rush to raise money before the US election. Hyundai Motor India Ltd. shares dropped about 6% early in their Mumbai debut on Tuesday after the company raised $3.3 billion in the South Asian nation’s largest-ever initial public offering.

In Japan, Tokyo Metro Co.’s $2.3 billion listing, which is scheduled for Oct. 23, was met with robust demand, with foreign investors seeking more than 35 times the shares on offer to them, according to several of the lead underwriters on the deal.

Horizon Robotics Inc. priced shares in its IPO at HK$3.99 each, the top of an offered range, according to terms of the deal obtained by Bloomberg News.

“Soft US markets are not usually a good set-up for Asia, where there are also a number of IPOs this week that will test retail and institutional demand,” Calder said.

Meanwhile, Beijing’s stimulus efforts to boost growth in its struggling economy continue to come under spotlight. Central Huijin Investment Ltd., a unit of China’s sovereign wealth fund that has at times bought equity to stabilize the stock market, issued bonds that pushed its total local debt sales this year to a record.

On Monday, Chinese banks cut their benchmark lending rates after easing by the central bank in September, part of a series of measures aimed at halting a housing market slump.

“The real question is how much does that stimulus translate into easing financial conditions such that it creates a durable increase in demand,” Jim Caron, CIO of Morgan Stanley Investment Management Portfolio Solutions Group, said on Bloomberg TV.

Japanese traders are keeping one eye on the run-up to this coming weekend’s election. Support for Prime Minister Shigeru Ishiba’s ruling coalition is continuing to soften, indicating the possibility that the vote may result in a weakened and unstable administration.

The currency markets remain on tenterhooks as the yen weakened against the dollar and reached the 151 level per dollar on Tuesday.

Gold rose — approaching Monday’s record high — with haven demand from traders paying attention to geopolitical risks, including conflict in the Middle East, and the US election. Oil fell after rising nearly 2% on Monday.

Key events this week:

-

ECB’s Christine Lagarde is interviewed by Bloomberg Television, Tuesday

-

BOE’s Andrew Bailey as well as ECB’s Klaas Knot and Robert Holzmann to speak at Bloomberg Global Regulatory Forum in New York, Tuesday

-

Philadelphia Fed President Patrick Harker speaks, Tuesday

-

Canada rate decision, Wednesday

-

Eurozone consumer confidence, Wednesday

-

US existing home sales, Wednesday

-

Boeing, Tesla, Deutsche Bank earnings, Wednesday

-

Fed’s Beige Book, Wednesday

-

US new home sales, jobless claims, S&P Global Manufacturing and Services PMI, Thursday

-

UPS, Barclays earnings, Thursday

-

Fed’s Beth Hammack speaks, Thursday

-

US durable goods, University of Michigan consumer sentiment, Friday

Some of the main moves in markets:

Stocks

-

S&P 500 futures fell 0.2% as of 6:28 a.m. London time

-

Nasdaq 100 futures fell 0.3%

-

Futures on the Dow Jones Industrial Average fell 0.2%

-

The MSCI Asia Pacific Index fell 0.9%

-

The MSCI Emerging Markets Index fell 0.4%

Currencies

-

The Bloomberg Dollar Spot Index was little changed

-

The euro was little changed at $1.0822

-

The Japanese yen was little changed at 150.89 per dollar

-

The offshore yuan was little changed at 7.1349 per dollar

-

The British pound rose 0.1% to $1.3002

Cryptocurrencies

-

Bitcoin fell 0.3% to $67,508.85

-

Ether fell 1.3% to $2,641.27

Bonds

-

The yield on 10-year Treasuries advanced two basis points to 4.22%

-

Germany’s 10-year yield advanced 10 basis points to 2.28%

-

Britain’s 10-year yield advanced eight basis points to 4.14%

Commodities

-

Brent crude fell 0.4% to $73.97 a barrel

-

Spot gold rose 0.5% to $2,733.53 an ounce

This story was produced with the assistance of Bloomberg Automation.

–With assistance from Jason Scott, Winnie Hsu and Abhishek Vishnoi.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.