News

- Today's news

- US

- Politics

- World

- Tech

- Reviews and deals

- Audio

- Computing

- Gaming

- Health

- Home

- Phones

- Science

- TVs

- Climate change

- Health

- Science

- 2024 election

- Originals

- The 360

- Newsletters

Life

- Health

- COVID-19

- Fall allergies

- Health news

- Mental health

- Relax

- Sexual health

- Studies

- The Unwind

- Parenting

- Family health

- So mini ways

- Style and beauty

- It Figures

- Unapologetically

- Horoscopes

- Shopping

- Buying guides

- Food

- Travel

- Autos

- Gift ideas

- Buying guides

Entertainment

- Celebrity

- TV

- Movies

- Music

- How to Watch

- Interviews

- Videos

Finance

- My Portfolio

- News

- Latest News

- Stock Market

- Originals

- The Morning Brief

- Premium News

- Economics

- Housing

- Earnings

- Tech

- Crypto

- Biden Economy

- Markets

- Stocks: Most Actives

- Stocks: Gainers

- Stocks: Losers

- Trending Tickers

- Futures

- World Indices

- US Treasury Bonds Rates

- Currencies

- Crypto

- Top ETFs

- Top Mutual Funds

- Options: Highest Open Interest

- Options: Highest Implied Volatility

- Sectors

- Basic Materials

- Communication Services

- Consumer Cyclical

- Consumer Defensive

- Energy

- Financial Services

- Healthcare

- Industrials

- Real Estate

- Technology

- Utilities

- Research

- Screeners

- Screeners Beta

- Watchlists

- Calendar

- Stock Comparison

- Advanced Chart

- Currency Converter

- Investment Ideas

- Research Reports

- Personal Finance

- Credit Cards

- Balance Transfer Cards

- Cash-back Cards

- Rewards Cards

- Travel Cards

- Credit Card Offers

- Banking

- CD Rates

- Best HYSA

- Best Free Checking

- Student Loans

- Personal Loans

- Insurance

- Car insurance

- Mortgages

- Mortgage Refinancing

- Mortgage Calculator

- Taxes

- Videos

- Latest News

- Editor's Picks

- Investing Insights

- Trending Stocks

- All Shows

- Morning Brief

- Opening Bid

- Wealth

- Invest

- ETF Report

- Streaming Now

Sports

- Fantasy

- News

- Fantasy football

- Best Ball

- Pro Pick 'Em

- College Pick 'Em

- Fantasy baseball

- Fantasy hockey

- Fantasy basketball

- Download the app

- Daily fantasy

- NFL

- News

- Scores and schedules

- Standings

- Stats

- Teams

- Players

- Drafts

- Injuries

- Odds

- Super Bowl

- GameChannel

- Videos

- MLB

- News

- Scores and schedules

- Standings

- Stats

- Teams

- Players

- Odds

- Videos

- World Baseball Classic

- NBA

- News

- Draft

- Scores and schedules

- Standings

- Stats

- Teams

- Players

- Injuries

- Videos

- Odds

- Playoffs

- NHL

- News

- Scores and schedules

- Standings

- Stats

- Teams

- Players

- Odds

- Playoffs

- Soccer

- News

- Scores and schedules

- Premier League

- MLS

- NWSL

- Liga MX

- CONCACAF League

- Champions League

- La Liga

- Serie A

- Bundesliga

- Ligue 1

- World Cup

- College football

- News

- Scores and schedules

- Standings

- Rankings

- Stats

- Teams

-

- MMA

- WNBA

- Sportsbook

- NCAAF

- Tennis

- Golf

- NASCAR

- NCAAB

- NCAAW

- Boxing

- USFL

- Cycling

- Motorsports

- Olympics

- Horse racing

- GameChannel

- Rivals

- Newsletters

- Podcasts

- Videos

- RSS

- Jobs

- Help

- World Cup

- More news

New on Yahoo

- Creators

- Games

- Tech

- Terms

- Privacy

- Your Privacy Choices

- Feedback

© 2024 All rights reserved. About our ads Advertising Careers Yahoo Finance Yahoo Finance Search query Select edition

- USEnglish

- US y LATAMEspañol

- AustraliaEnglish

- CanadaEnglish

- CanadaFrançais

- DeutschlandDeutsch

- FranceFrançais

- 香港繁中

- MalaysiaEnglish

- New ZealandEnglish

- SingaporeEnglish

- 台灣繁中

- UKEnglish

Sign in

- My Portfolio

- News

- Latest News

- Stock Market

- Originals

- The Morning Brief

- Premium News

- Economics

- Housing

- Earnings

- Tech

- Crypto

- Biden Economy

- Markets

- Stocks: Most Actives

- Stocks: Gainers

- Stocks: Losers

- Trending Tickers

- Futures

- World Indices

- US Treasury Bonds Rates

- Currencies

- Crypto

- Top ETFs

- Top Mutual Funds

- Options: Highest Open Interest

- Options: Highest Implied Volatility

- Sectors

- Basic Materials

- Communication Services

- Consumer Cyclical

- Consumer Defensive

- Energy

- Financial Services

- Healthcare

- Industrials

- Real Estate

- Technology

- Utilities

- Research

- Screeners

- Screeners Beta

- Watchlists

- Calendar

- Stock Comparison

- Advanced Chart

- Currency Converter

- Investment Ideas

- Research Reports

- Personal Finance

- Credit Cards

- Balance Transfer Cards

- Cash-back Cards

- Rewards Cards

- Travel Cards

- Credit Card Offers

- Banking

- CD Rates

- Best HYSA

- Best Free Checking

- Student Loans

- Personal Loans

- Insurance

- Car insurance

- Mortgages

- Mortgage Refinancing

- Mortgage Calculator

- Taxes

- Videos

- Latest News

- Editor's Picks

- Investing Insights

- Trending Stocks

- All Shows

- Morning Brief

- Opening Bid

- Wealth

- Invest

- ETF Report

- Streaming Now

Upgrade to Premium Fed Minutes to Offer Clues on How Far and Fast Officials Can Cut

1 / 3

Fed Minutes to Offer Clues on How Far and Fast Officials Can Cut

Craig Torres Tue, Nov 26, 2024, 4:00 AM 5 min read

(Bloomberg) — Several Federal Reserve officials have signaled they’re open to cutting interest rates at a more deliberate pace next year as they grapple with the uncertainties of a Republican takeover in Washington, a pickup in productivity and slower improvement on inflation.

Most Read from Bloomberg

-

New York City’s ‘Living Breakwaters’ Brace for Stormier Seas

-

In Kansas City, a First-Ever Stadium Designed for Women’s Sports Takes the Field

-

NYC's Underground Steam System May Be Key to a Greener Future

-

NYC Gets Historic Push for 80,000 Homes With $5 Billion Pledge

Minutes of the Federal Open Market Committee’s Nov. 6-7 meeting, set for release at 2 p.m. in Washington, could provide more clues on whether policymakers are rethinking how fast and how far to lower borrowing costs.

Chair Jerome Powell, Dallas Fed President Lorie Logan and Governor Michelle Bowman are among those suggesting they’re in no rush, though none has ruled out a rate cut at the Fed’s next meeting in December.

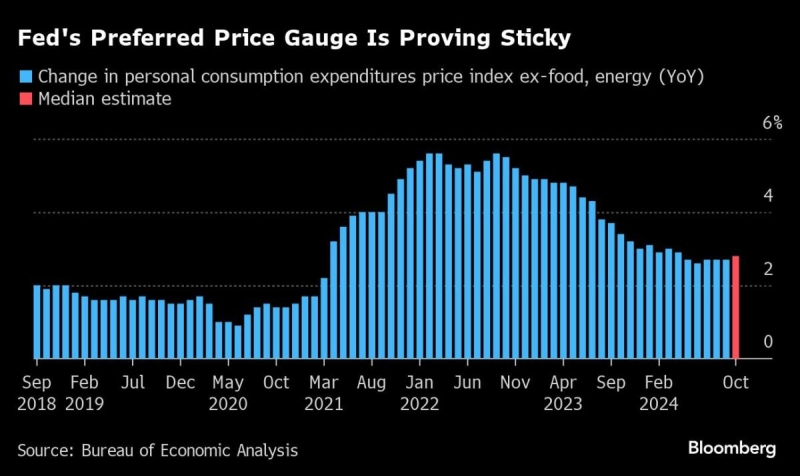

“They want to make sure they give themselves optionality, with growth being more resilient and inflation showing a bit more stickiness,” said Kathy Bostjancic, chief economist at Nationwide.

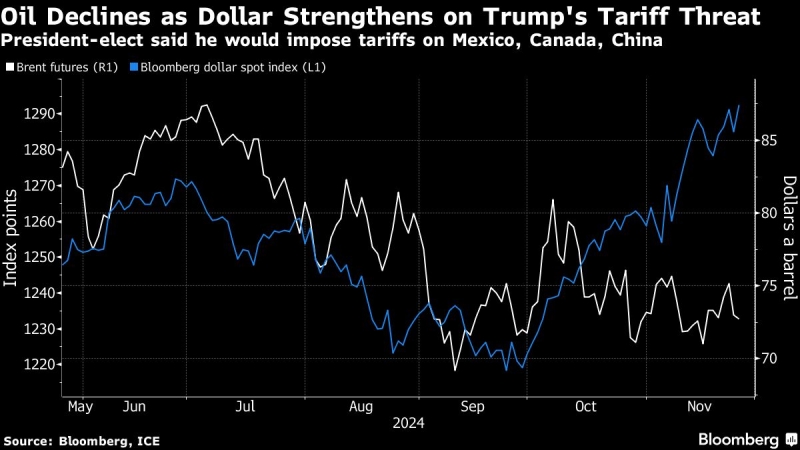

Fed officials lowered interest rates in November, but investors have pared bets for another reduction next month. Odds of a quarter-point cut in December are just above 50-50, down from about 80% before the November meeting.

The minutes could shed light on three big issues emerging from the recent public remarks of policymakers:

Higher End Point

A number of Fed officials have said they are now aiming, over time, to bring the policy rate down to a level that neither restrains nor stimulates the economy. But many of them also appear to be reassessing what that so-called neutral rate is, based on the economy’s surprisingly strong performance over the past two years.

“My estimate of the neutral policy rate is much higher than it was before the pandemic,” Bowman said Nov. 20. There’s a risk that if the Fed keeps cutting “the policy rate may attain or even fall below its neutral level before we achieve our price stability goal.”

If borrowing costs were to fall below neutral, policymakers would face the unwelcome risk of overstimulating the economy and fanning price increases.

“I see substantial signs that the neutral rate has increased in recent years, and some hints that it could be very close to where the fed funds rate is now.” — Lorie Logan, Nov. 13

A quarter-point cut next month would bring the federal funds rate down to a range of 4.25% to 4.5%. The full percentage point of easing since September would be the fastest pace of rate reductions outside a crisis since 2001. It would also leave borrowing costs just about 75 basis points above an investor-preferred proxy for the neutral rate.

Fed officials are required to submit their own estimates of neutral, also known as the “longer-run” fed funds rate, each quarter. Those estimates have been steadily climbing, with the forecast median at 2.9% in September, up from 2.5% in December 2023. But policymakers were sharply divided in the latest projections: 12 officials estimated neutral in a range of 2.375% to 3%, while seven forecast 3.25% to 3.75%.

Both the economy and markets seem to agree with the higher rate group. While most Fed officials maintain policy is still restrictive, overall demand remains healthy, and inflation is still not convincingly settled around the 2% goal.

Productivity Surge

A pickup in US labor productivity has been another surprise, following years of tepid growth.

The key ingredient to raising living standards, an acceleration in output per hour is always welcomed by Fed officials. It’s a sign of labor becoming more efficient with the help of better technology. But it also raises questions for monetary policy.

A more productive economy allows for faster growth without sparking inflation. More investment in capital, meanwhile, is typically needed to sustain that growth.

“The economy is not sending any signals that we need to be in a hurry to lower rates.” — Jerome Powell, Nov. 14

Jason Thomas, head of global research and investment strategy at Carlyle Group Inc., said the productivity bump, combined with the potential of growth-fueling tax cuts from the incoming Trump administration, raises the risk the Fed may cut too much, too soon.

“In terms of risk and reward, I can’t imagine them wanting to cut into that,” he said. “You have higher demand for capital and labor, and if you take rates too low you have an over-stimulation, which generates inflation.”

Thomas expects one to two more additional rate cuts, possibly in March and June.

2% Inflation

Fed officials believe they’re on their way to price stability, but are not there yet, and President-elect Donald Trump’s proposals introduce substantial uncertainty. Deregulation and tax cuts could boost growth and spur inflation. Tariffs and deportations could dampen consumption, investment and growth, while also raising prices. Nobody really knows how the mix of proposals will play out.

Loretta Mester, the former Cleveland Fed President, said a takeaway from the post-pandemic inflation surge in 2021 is that policy needs to be ready to respond to a range of risks in times of high uncertainty, and that probably translates into a gradual pace of cuts.

“What you want to do is make sure you keep policy well-positioned so that you can address whichever way the risks manifest themselves,” said Mester, now an adjunct full professor of finance at the University of Pennsylvania’s Wharton School. “With the strength in the economy, there is no reason to hurry.”

–With assistance from Vince Golle.

Most Read from Bloomberg Businessweek

-

What Happens When US Hospitals Go Big on Nurse Practitioners

-

Why the Flying Experience Feels So Much Worse

-

The Charm Bracelet Shop That Keeps Going Viral

-

Clear’s Dominance in Airports Could Be Coming to an End

-

An Airline’s Florida Resort Dreams Look More Like a Nightmare

©2024 Bloomberg L.P.

Terms and Privacy Policy Your Privacy Choices